India’s financial sector is undergoing rapid expansion, both in terms of growth of existing financial services firms and new entities entering the market. However, serving a population of over 1.3 billion people is an enormous task. A large part of India still remains outside the formal economy and have little or no access to basic financial services. This has resulted in a large under-serviced population, left behind in the rapid strides that the country took in financial technology over the last few years. Insights Success feels privileged to tell you about an industry leader, serving the underserved population tirelessly. We are delighted to introduce to you PayNearby, a flagship brand of Nearby Technologies Private Limited.

PayNearby provides last mile access of basic financial services to India’s large distributed populace who are digital shy and have not still not integrated to formal economy. It works on a B2B2C model through its various brands – PayNearby, InsureNearby, BuyNearby, TravelNearby and among others.

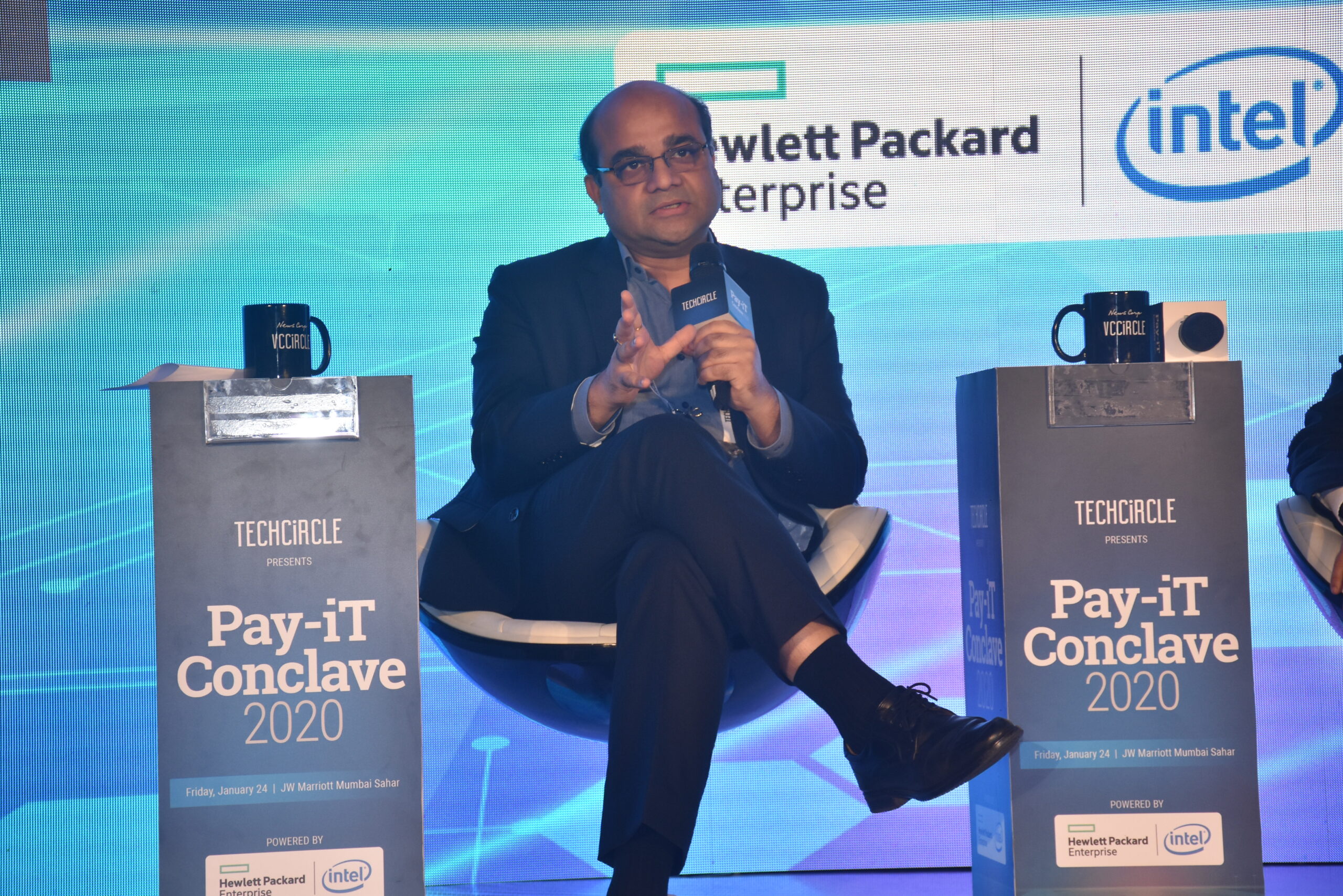

The Leading Light of PayNearby

PayNearby is under the leadership of, Anand Kumar Bajaj – MD & CEO, an IIM-A alumnus and a Chartered Accountant with over 18 years of experience in Digital Payments and Mobility. Previously, he has served YES Bank, ICICI Bank, and Ernst & Young.

At Nearby Technologies, Anand and his team are committed to bridging the digital gap in India through scalable technology, grass-root level distribution, and empowerment of the last mile. In this endeavor, Anand works closely with RASCI, TRRAIN, and other industry bodies to upskill and empower retailers, who form the hub of local communities and can bring meaningful changes in society.

Unyielding Roots in the Industry

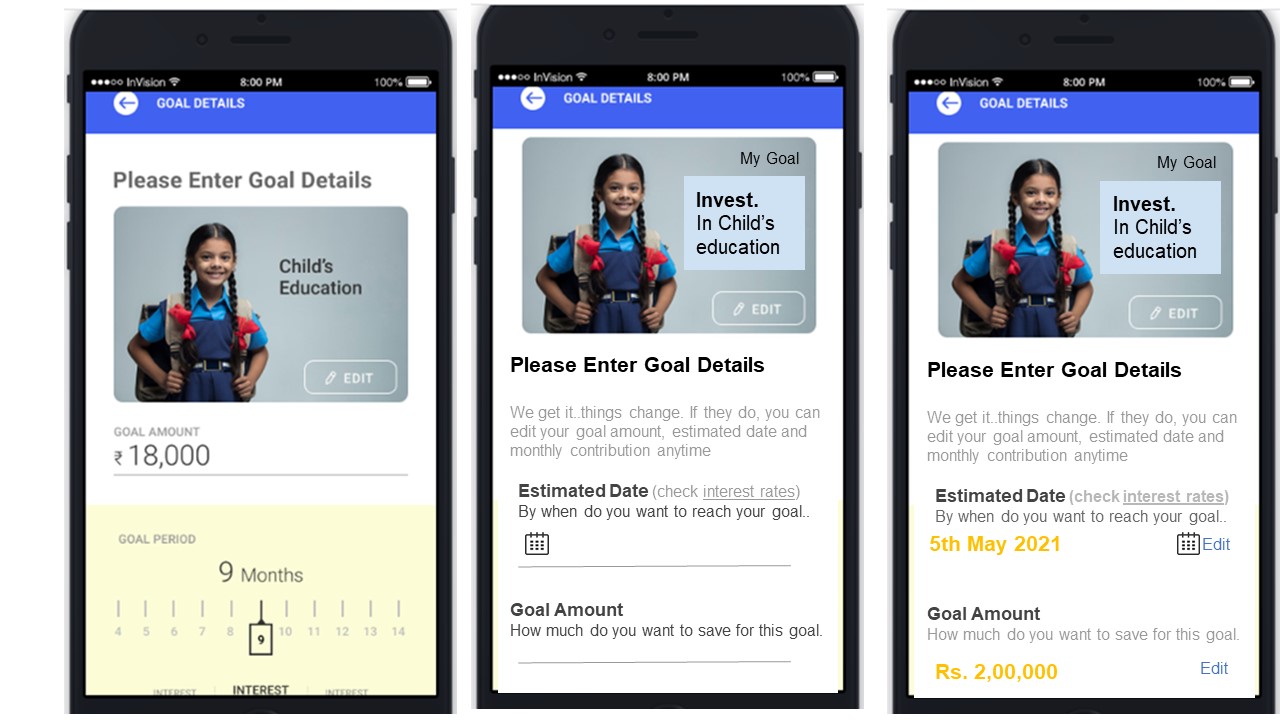

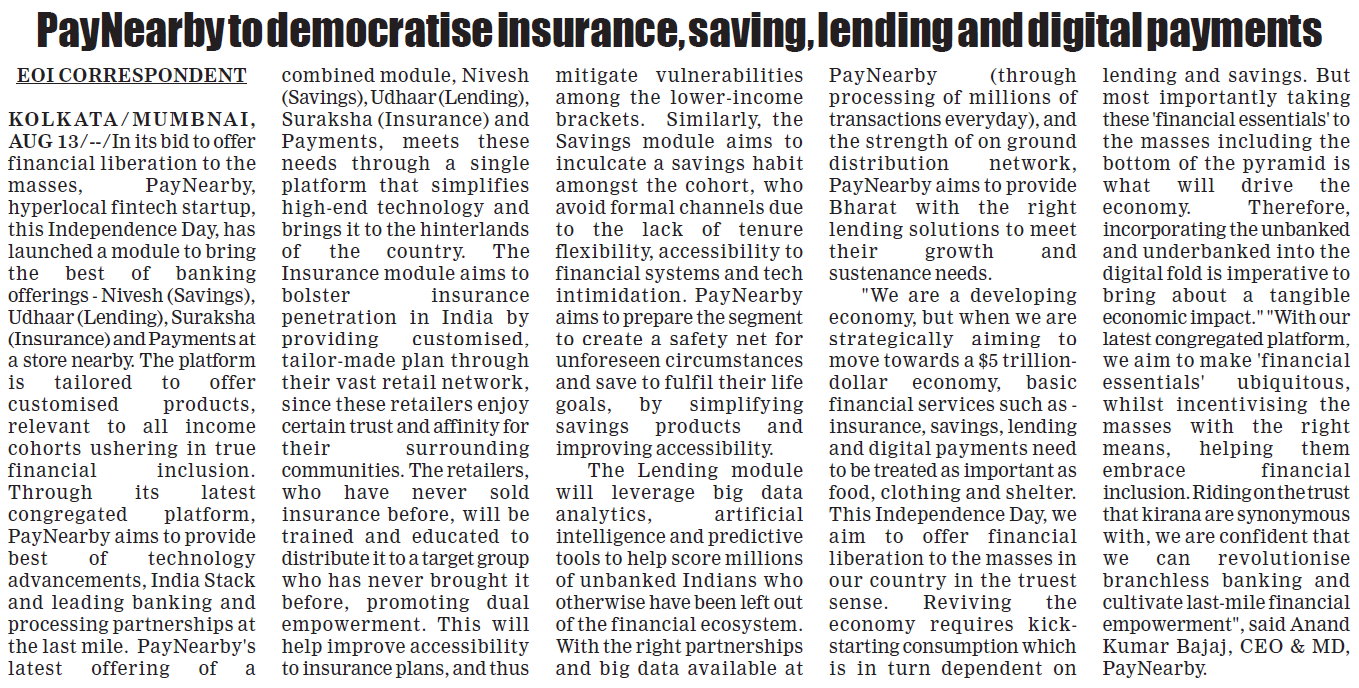

Incepted in 2016, PayNearby empowers local retail shops to offer financial products leveraging assisted technology led modules. The company offers a bouquet of financial services including cash withdrawal, domestic remittances, utility bill payments, card payments, savings products, insurance, and many others. Through retailer empowerment, it ensures that access to financial services is available in every district, town and villages, thereby moving towards a cashless economy.

PayNearby has enabled local retailers to utilize a variety of digital services to serve customers in their catchment areas. With PayNearby Domestic Money Transfer service, retailers can help customers instantly transfer their money to any bank account in the country, anywhere and anytime. Products like BBPS powered Bill Payment services help customers easily pay utility bills across 100+ billers and through AePS and Micro ATMs, users can now withdraw money from their nearest local store.

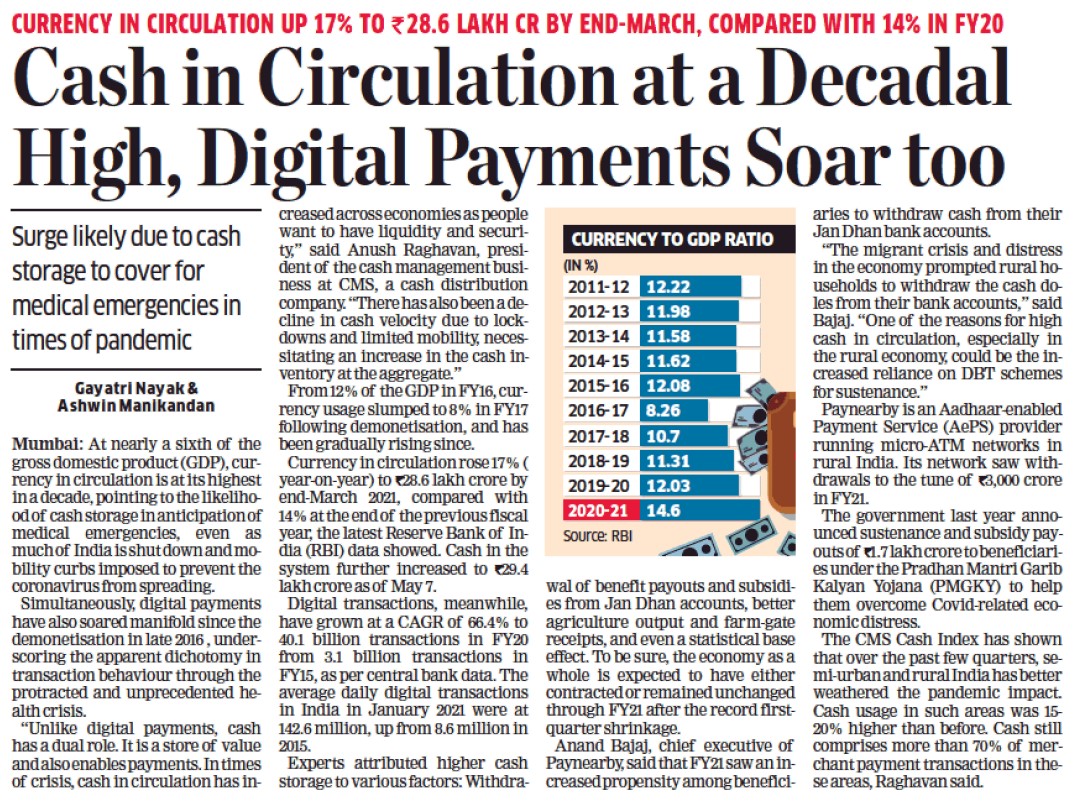

According to the firm, its biggest differentiator in the market is its technology architecture. Such setup not only promises the highest success ratio but maximizes efficiency in retailers’ daily lives. Consequently, PayNearby is leading the segment with Aadhaar Enabled Payment System (AePS), or Aadhaar banking with 33% market share, which facilitates cash withdrawal, and balance inquiry through customer’s Aadhaar number and fingerprint authentication. Applying the mantra of “Automate or Eliminate”, PayNearby has automated every functionality, which has helped the company scale and handle large volumetric data.

With the huge success and adoption that the company has seen in the first 3 years of its operation, PayNearby is now geared for its next phase of growth. It is well-positioned to move forward to version 2.0 with the launch of new verticals like Travel and Insurance. The company has also applied for an NBFC license to meet the financial needs of the Retailing Community. “The rich data analytics that we have on the retailer are valuable inputs to risk scoring and will allow us to provide customized lending solutions to our retail partners and customers”, says Anand.

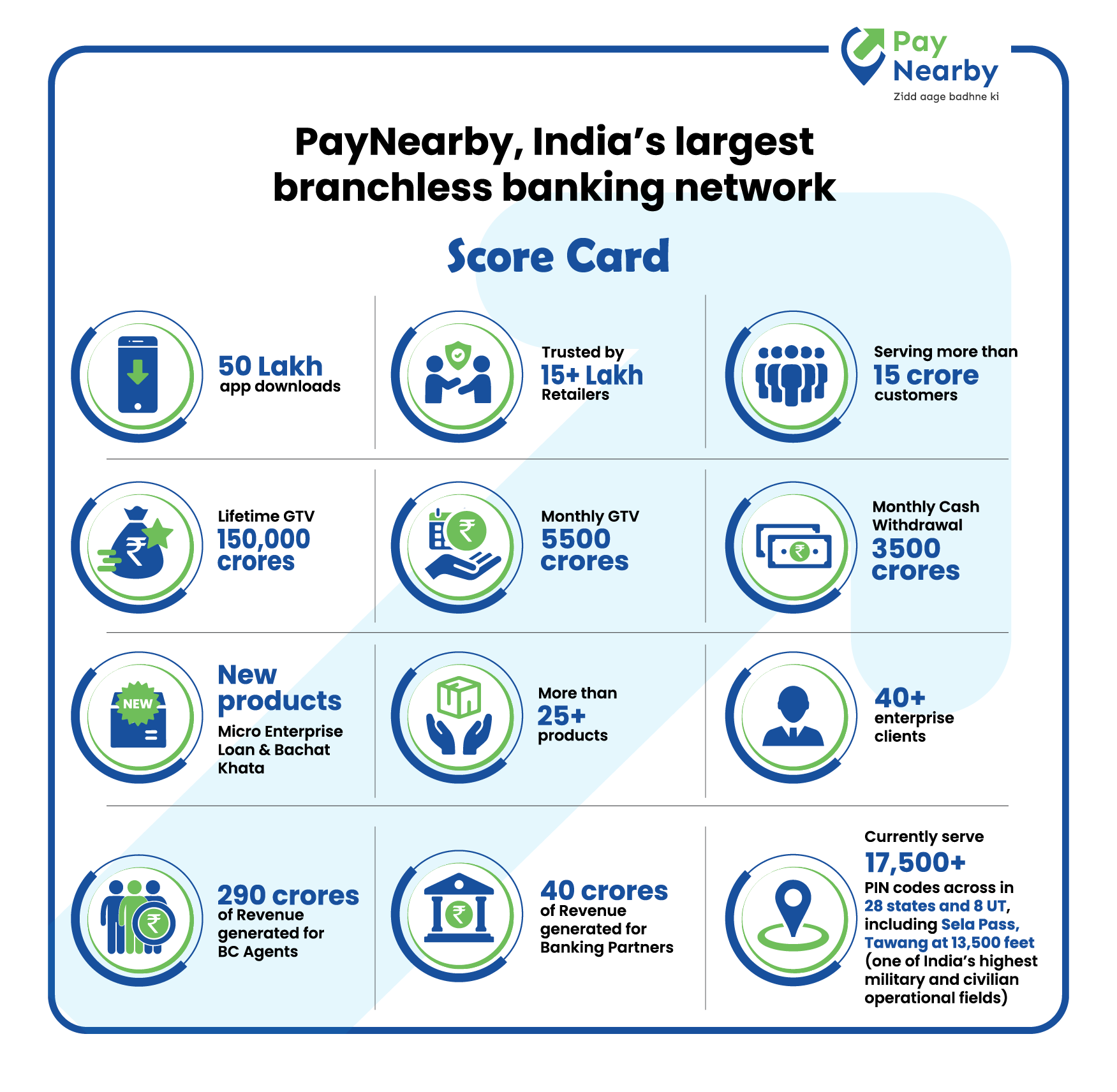

PayNearby stands strong today with a stellar performance of:

- 10,00,000 + daily transactions, registered retailers ~800,000+ serving more than ~10 crores customers

- Serving 16,772+ PIN codes in 28 states and 9 union territories in India

- 33% AePS market share, serving India’s 93% rural population

- Expected to cross Rs. 70,000 Crore GTV in FY 19-20

- Partnership with RASCI for over 24,000 PayNearby retailers certified under NSDC

- InsureNearby another Nearby Technologies brand with certification of over 30000+ Point of sale Persons (POSP) for selling insurance products.

Awards:

- CA Innovator Award – January 2019

- World Payments Congress – February 2019 – 50 Most Influential Payment Professionals

- SKOCH Order-of-Merit Awards – June 2019

- Category Leader for Fastest Growing Digital in Kirana Segment – April 2019

- DigiDhan Mission FinTech – October 2019 – Innovation in Digital Payments Acceptance Infrastructure in Rural India

Scaling New Horizons

From 8,00,000 retailers to 50,00,000 retailers in the near future, PayNearby has set aggressive goals to ramp up and be the port of call for assisted hyperlocal services in the county.

The company also plans to foray into international markets with active evaluations in Sri Lanka, Bangladesh, and South Asia markets. “The level of digitization in this region is similar and remarkably high, alongside, the state of banking which remains similarly low. Hence, adoption of our platform in the local context of this region ‘nearby’ is obvious extension”, concluded Anand.

You can know more about the company by visiting https://paynearby.in/

- Source – Insights Success

- Published Date – January 16, 2020