On the occasion of India’s 76th Independence Day, PayNearby releases its first edition of ‘Bharat Health Index’ – a study of healthcare awareness in Bharat

- 15-20% of yearly income spent on medical expenses in Bharat households

- 55% of those surveyed have never heard of insurance

- 70% did not have a health insurance cover

- 23% relied on informal loans or borrowing to take care of hospital expenses

- 45% travelled more than 10 kms to avail doctor services

- 35% of respondents expressed interest in online medical purchases

- 32% have shown interest on telemedicine consultation

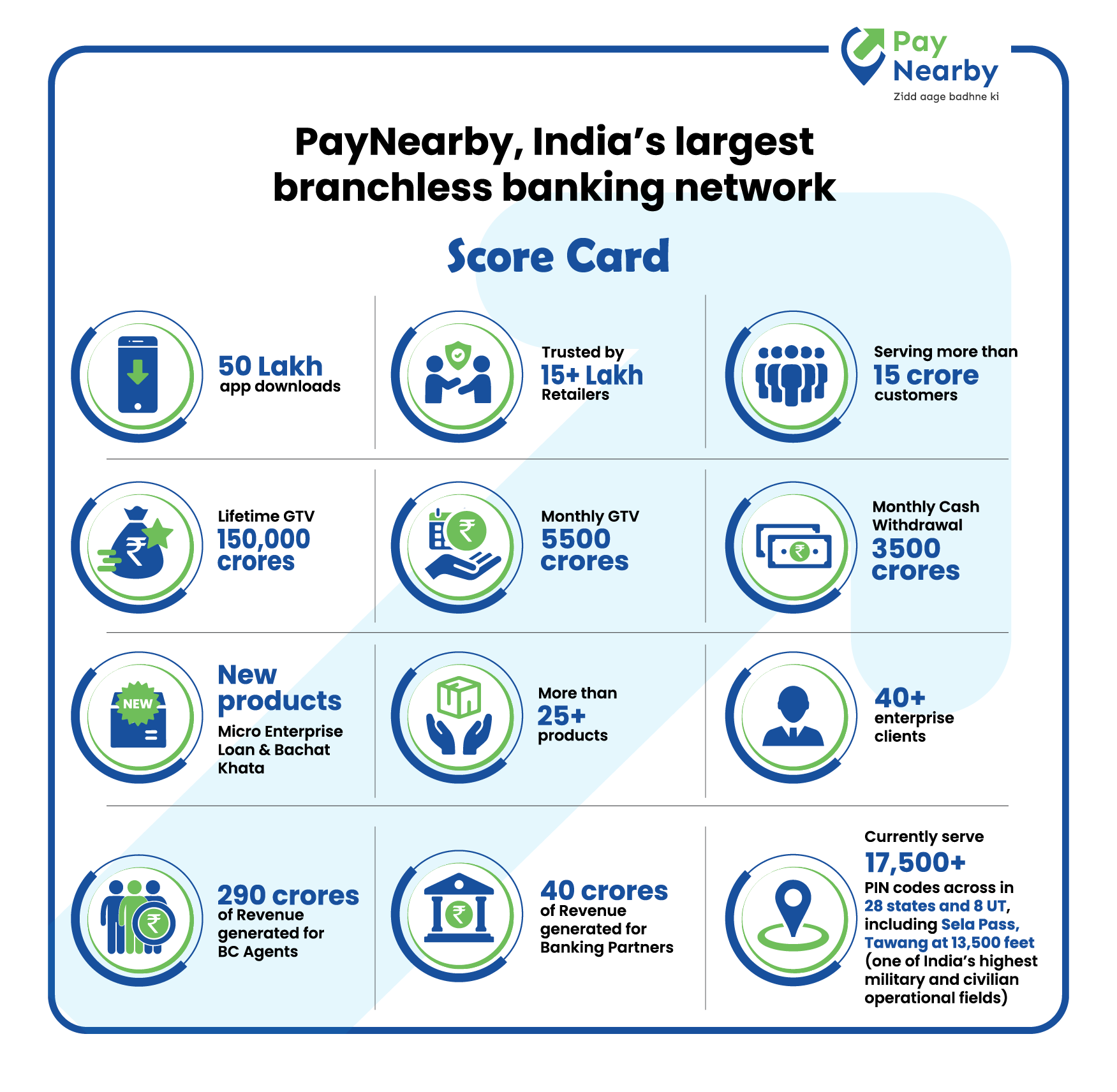

Mumbai, 11th August, 2023: Only 25% of the semi-rural and rural population in India have access to modern healthcare within their localities, highlighted a survey titled Bharat Health Index (BHI) 2023, released by PayNearby, India’s largest branchless banking and digital network. The accessibility index saw a major dip as one moved from urban to rural India, with only 10% of the rural respondents citing that they had access to healthcare within a 10km radius.

These findings are based on survey responses of 10,000+ retailers across semi-rural and rural India over a month.

Lack of skilled healthcare providers at the last mile pose a significant challenge for accessibility. Only 15% of respondents confirmed having a doctor’s clinic or healthcare facility within a 5 km radius. In terms of medical practitioners available, while 25% had access to general physicians in their area, 92% lacked specialised doctors, such as cardiologists, gynaecologists or paediatricians, impacting medical care.

For specialised treatment such as cancer, neurological or blood disorders, 90% needed to travel to a different location for treatment. 5% reported loss of a loved one due to unavailability of specialist doctors at the local healthcare facility. The survey also evaluated the accessibility and convenience of medical stores at the last mile. A notable 52% of respondents had a pharmacy within 5 km radius of their residence, making essential medicines relatively accessible. However, 85% of the respondents had to travel more than 10 kms to obtain specialised medicines, indicating potential challenges for those with specific medical needs.

Interestingly, 47% of the respondents possessed a thermometer at home, while only 7% had instruments to check blood pressure and blood sugar, suggesting room for improved self- monitoring and prevention.

The survey also examined the funding mechanism for medical expenses and how affordability could be improved at the last mile. The report indicated that an average household in Bharat spent approximately 15-20% of their yearly income on medical expenses. 23% relied on informal loans or borrowing for hospital expenses, while 6% resorted to selling assets to pay off their medical bills. A significant 53% utilised some form of savings to cover these expenses. Given the dependence on out-of-pocket expenses for medical costs, the survey emphasized the urgent need for setting up a financial funding mechanism to address the escalating medical expenses at the last mile. The penetration of financial products such as insurance emerged as crucial for enhancing healthcare affordability and accessibility. However, the report highlighted the abysmally low insurance awareness among Bharat’s last mile. A substantial 55% of the respondents had never heard of insurance. Among those aware of insurance, only 32% had opted for insurance at some point, with a mere 28% possessing health insurance for themselves or their families. Among those with insurance, 88% obtained it from government or state sponsored schemes, while less than 10% obtained it from private insurance providers.

For those without insurance, reasons varied. A substantial 38% cited affordability as a major hindrance, while others mentioned uncertainty about where to buy insurance (36%) or its benefits (24%). Respondents identified limited availability of health insurance providers and lack of information (32%) as the primary challenge. This was closely followed by high premiums (28%), complex documentation processes (15%), limited coverage for specific healthcare needs (18%), and language or literacy barriers (7%).

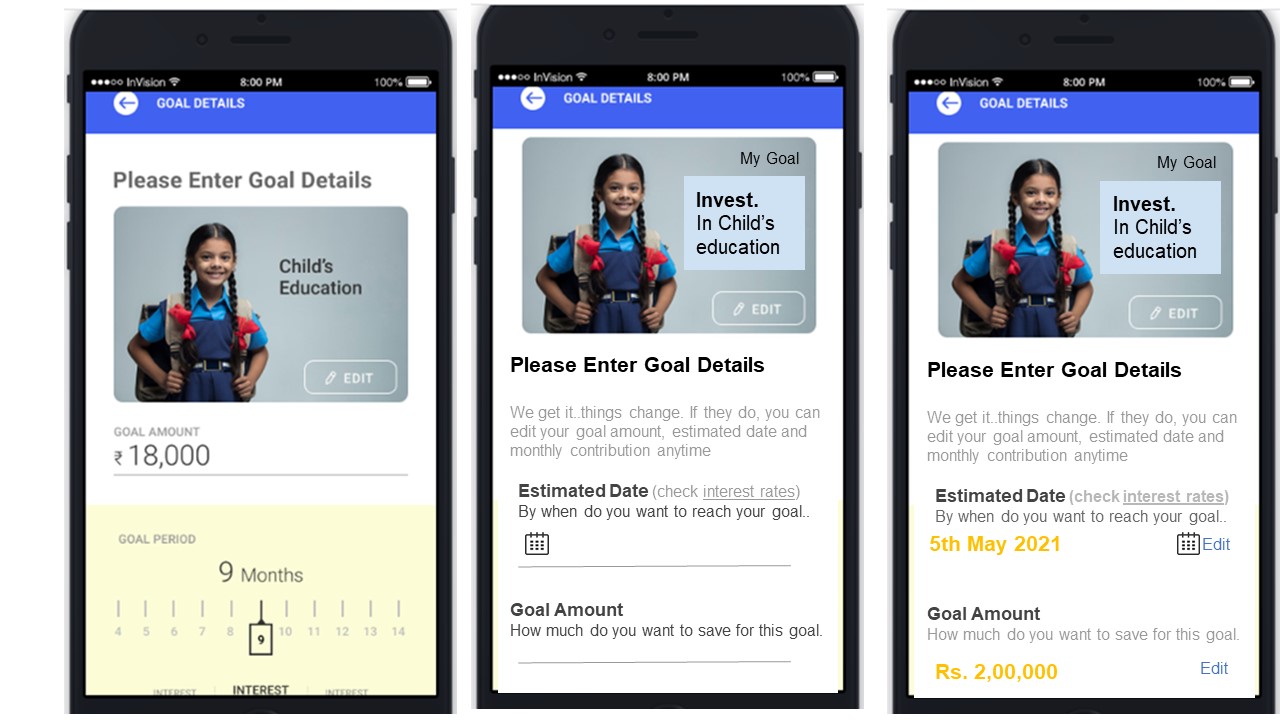

To improve overall accessibility of healthcare services, the survey also evaluated the affinity for online medicine purchase and teleconsultation among this population. 35% expressed interest in online medical purchases, 32% favoured telemedicine consultations, and 32% showed keenness for online awareness programs and diagnostics/lab tests- online appointments. The encouraging response towards digital adoption highlights the need for tech-led innovations and distribution models to broaden healthcare reach across the country.

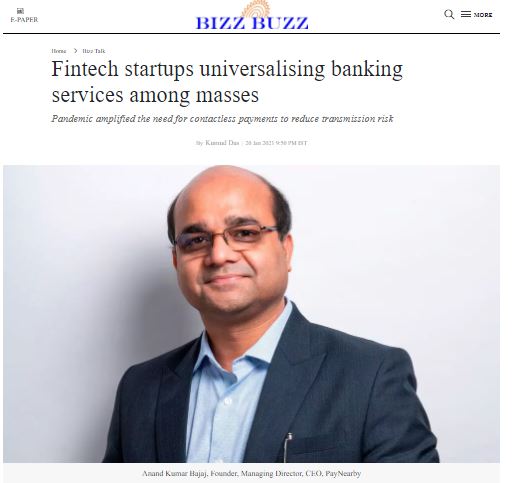

Commenting on the findings, Mr. Anand Kumar Bajaj, Founder, MD & CEO, PayNearby said, “Over 70% of India resides in rural and semi-rural regions. This survey reinforces the urgent need to scale healthcare services for the masses. More than 80% of doctors, 75% of dispensaries, 60% of hospitals are concentrated in urban India, leaving out marginalised population in SURU to fend for themselves. While infrastructure scaling takes times, leveraging technology for distribution breakthroughs is crucial to cater to a wider audience. Reliable tele-consultation platforms and easy to use online pharmacy modules can greatly contribute. Our recently launched Health Correspondent program, is a step in that direction. Together with our retailers, the mission is to spread medical awareness and create local health hubs, ensuring the reach of critical primary health services through technology.

The survey also highlights the low penetration of insurance among our populace. To address this, more dialogue and action are needed to facilitate better insurance penetration in the country. This Independence Day, PayNearby has introduced Risk se Freedom Pao campaign, to not only build awareness but also eliminate roadblocks that keep people from availing insurance products. It’s critical that people perceive health insurance in the right light for a safer, better future for themselves and their families. “

Commenting on the report findings, Jayatri Dasgupta, CMO, PayNearby, said, “As India celebrates its 76th Independence Day, an important yardstick to measure the health of the nation is to understand the state of health infrastructure and awareness among the country’s last mile. Affordable and accessible healthcare is pivotal for country’s progress. PayNearby’s Bharat Health Index (BHI) 2023 initiative addresses gaps in existing healthcare infrastructure and outlines ways to enhance it. The survey highlights the need for more trained medical professionals in rural areas, a better financial support system for medical expenses, accelerated insurance penetration, and the strategic use of technology for distribution breakthroughs.”

- Source – Press Release

- Published Date – August 11, 2023