India’s USD 200 billion digital payments industry is preparing for five-fold growth to reach USD 1 trillion by 2023. Over the years, money has taken several forms with the transitions in the digital payments domain. As money becomes increasingly decentralised, banks and fintech companies need to find ways for tapping the market potential with collaborative partnerships. At the recently-concluded 2020 edition of the Pay-iT Conclave by TechCircle and Hewlett Packard Enterprise, banks, FinTech firms, and technology experts came together to discuss the emerging trends, challenges, and opportunities for stakeholders in the digital payments industry.

Future of Payments in India

While speaking of the future of payments, Shalil Gupta, Chief Business Officer, Mosaic Digital shared that as per recent research findings, digital payments will be multi-device and social by 2023. So, to prepare for the future, businesses need to build extensive digital capabilities. After an analysis of the failures and successes of different forms of money, it was concluded that an agile, flexible, and open approach to create digital solutions will foster innovation.

Cybercriminals are also getting smarter with time. India has seen sophisticated cyberattacks in recent times. Therefore, safeguarding the money of the future with upgraded enterprise security becomes essential for the growth of the digital payment solutions ecosystem.

Dr. N. Rajendran, Chief Technology Officer, National Payments Corporation of India (NPCI) shared insights on the digital transformation brought about by innovative solutions such as RuPay and UPI in the banking sector. According to him, “130 million transactions are processed daily on the UPI platform.” NPCI introduced the National Electronic Toll Collection (NETC) FASTag system to streamline NHAI toll payments and reduce the waiting time at toll booths.

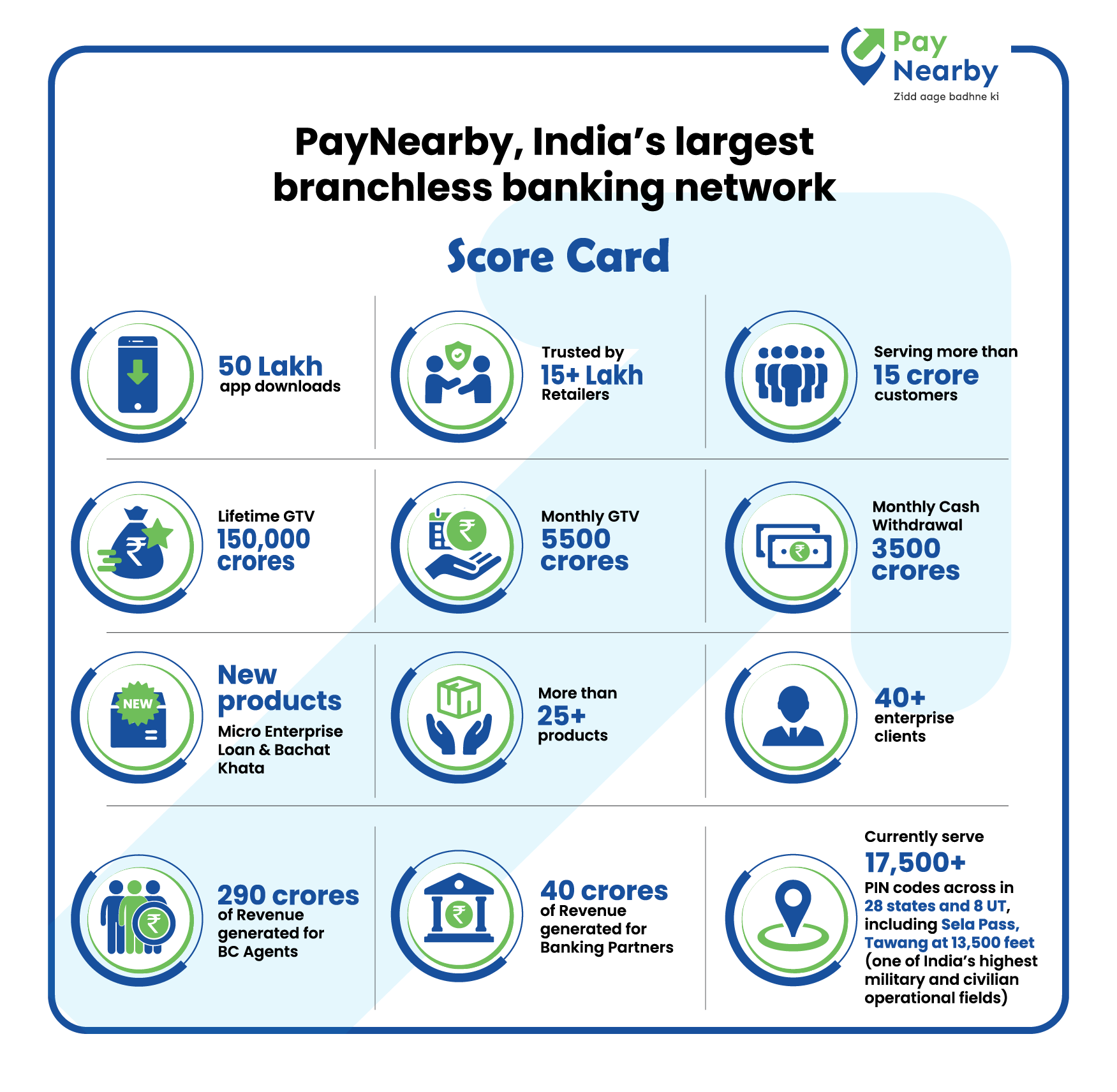

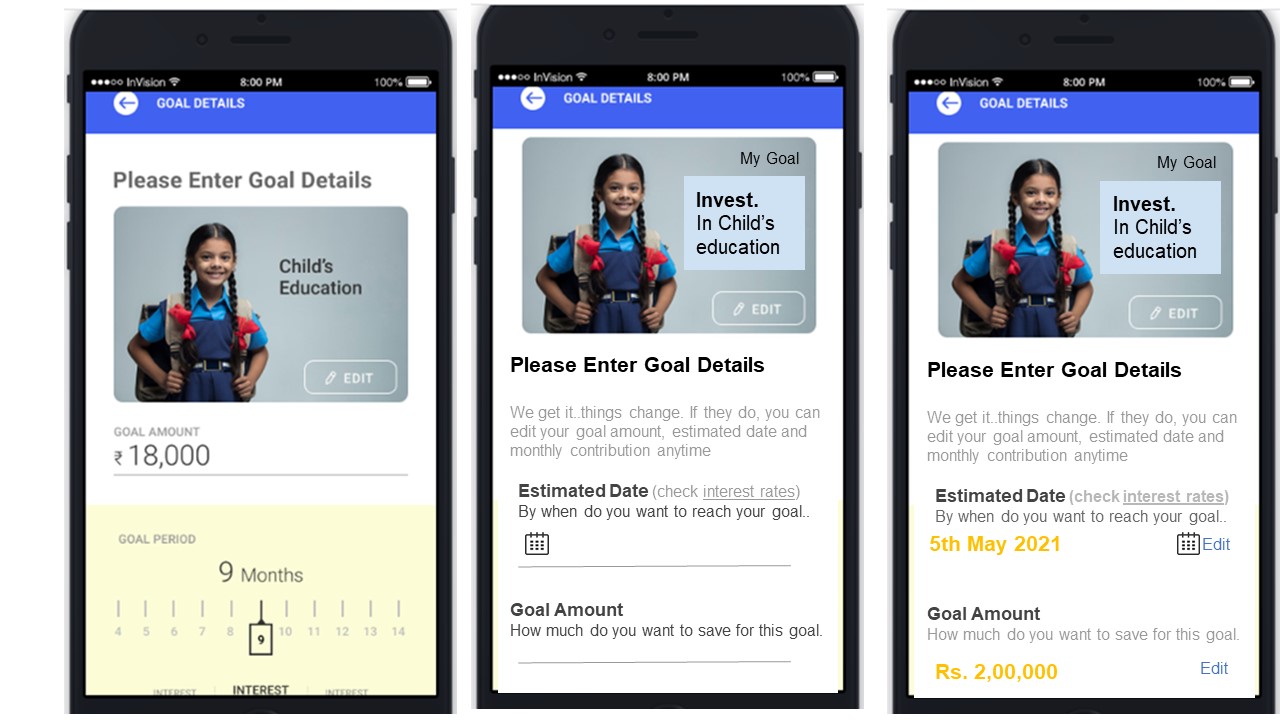

The panel discussion moderated by Jaideep Mehta, CEO, Mosaic Digital involved discussions on exploring the relationships between banks and fintechs. Panelists included Anand Kumar Bajaj, Founder-CEO, PayNearby; Aneish Kumar, MD & Country Manager, The Bank of New York Mellon – India and Rajesh Dhar, Senior Director – Hybrid IT, Hewlett Packard Enterprise. Thought leaders of the digital payments industry reiterated the fact that Gen Z prefers mobile solutions. Gen Z is impatient and loves efficiency. Also, 55% Gen Y in India dislike conventional banking systems. With the rise of mobile payment solutions, ATMs will soon start vanishing. Businesses will lose opportunities if they fail to implement new payment tech trends such as OTP verification on time. Also, capabilities are needed for businesses to manage data privacy and to handle AI/ML/Analytics walkthroughs. Besides, the usage of plastic cards can be reduced by converging them into mobile solutions. Instead of using multiple systems, organisations should think about building a single integrated system using APIs for smoother processes.

As far as challenges are concerned, large as well as small players have their share of issues while moving towards the platform economy. Earlier, legal and complicated processes were intimidating FinTech companies who were keen on partnering with banks. Today, the key challenges of the platform economy include customer-centricity, real-time data analytics, and innovations. Anand Kumar Bajaj, Founder-CEO, PayNearby, suggested utilising sandbox set-ups for working with the API environment. Investing heavily in technology may not be feasible for innovative FinTech entrepreneurs. In such cases, entrepreneurs can leverage the asset leasing facilities by HP Enterprise.

- Source – VC Circle

- Published Date – February 7, 2020