The micro, small and medium enterprises (MSME) sector in India is often referred to as the ‘engine of growth’ which contributes significantly to employment generation, exports, innovation, inclusive growth and the socio-economic development of the country. The entrepreneurial growth and development they contribute are not limited to the urban areas only. Of the 63 million MSMEs, 51 per cent are based in rural India. This increasingly growing sector contributes 30 per cent to the country’s GDP and 48 per cent to exports. Notably, the MSME sector creates around 1.3 million jobs per annum which employs over 120 million people and is undeniably very valuable to the Indian economy.

Over the past year, because of the COVID-19 headwinds, the sector has been valiantly trying to hold its ground. Several reports show that disruptions caused by the pandemic have impacted MSME earnings by 20-50 per cent. Micro and small enterprises have faced the maximum heat, mainly due to the liquidity crunch and drying up of consumer demand. This has impacted around 82 per cent of small businesses. To overcome these challenges, various tech-led companies have come forward to help MSMEs with innovative solutions.

India has a lot of catching up to do when it comes to digital maturity in the small and medium businesses segment; digitisation of SMEs is far more challenging than it seems due to several issues like lack of skills, tech-shyness, access to talent, lack of business-specific technologies among various others. Many fintechs have come forward and are partnering with MSMEs to solve for these challenges. From easy access to banking products, like account creation, credit management, cash flow management to assisted modules that help enterprises walk up the tech maturity curve, the examples are many.

The advantage of working with tech-led new-age platforms is the nimble footedness and flexibility they allow, which enable MSMEs to adopt solutions based on individual tech readiness and life-cycle requirements. Business critical solutions like improving the loan application process, aiding merchants to accept digital payments, seamless repayment options through digital pathways—which are vital to any business today—have been efficiently accomplished because of the MSME-fintech partnerships.

Among the many used cases it has solved for, the advent of technology and greater participation of private financial organisations has helped bridge the gap of credit requirements in this sector. Access to working capital for enterprises with thin credit files have been made possible through the intersection of technology and newer business models offered by fintech organizations.

At present, the MSME credit gap is pegged at around $240 billion (INR 17 lakh crore). By collaborating with digital fintech organizations, which are equipped with technology-enabled systems and algorithms, MSMEs can access capital at a much lower cost. The speed and agility offered by online market places and digital solutions not only aid in better discovery and information assimilation, but also help MSMEs adopt most cost effective solutions based on individual requirement. Digital lenders rely on alternate data acquired through social listening, intuitive tools and predictive algorithms and are able to offer enhanced customisations with greater flexibility suited to the borrowers’ needs, even without a credit history. Timely access to credit is the lifeblood of any business. Enabling MSMEs to gain easy access to credit is thus an important milestone in MSME-Fintech partnership.

Besides easy access to credit, empowering MSMEs with the latest digital payment solutions is another important area where we have seen much progress over the last few years. Digital payments help merchants not only service a wider range of customers, but also bring ease and efficiency to business operations by eliminating cash based transactions, which are expensive and fraught with security challenges. From form agnostic payment solutions which enable merchants to accept payments over easy tap and pay on mobile, to QR codes and payments through biometric authentication, this space has seen incredible innovation over the last few years. In addition, solutions like digitizing customer ledger allowing enterprises to better manage cash flows, along with better vendor management and workforce management tools are helping small and medium businesses to organize themselves better and get maximum output from available resources in these challenging times.

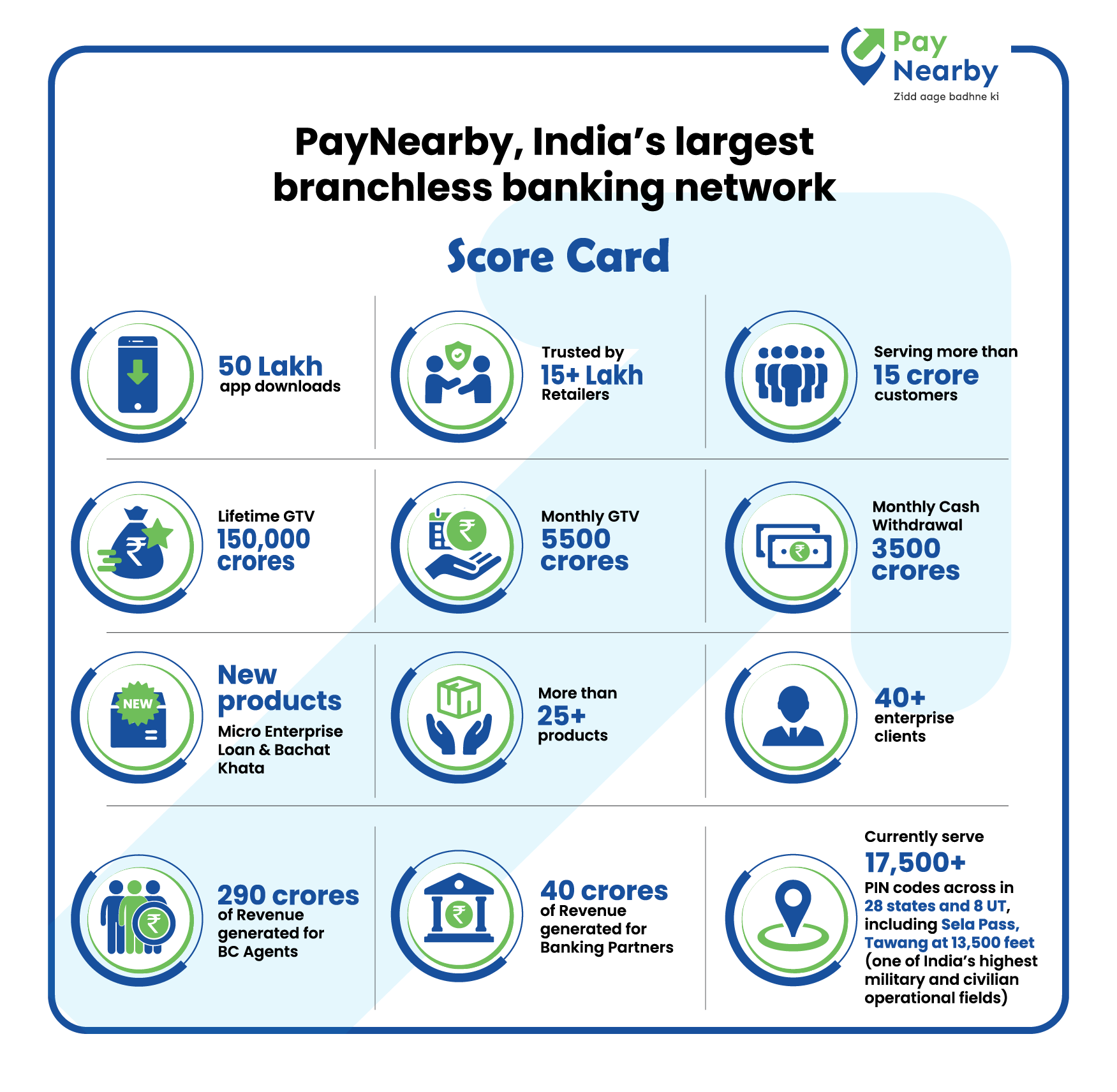

Another important area where technology participation has led to visible growth in the MSME sector is the opening up of newer revenue streams for small and medium businesses on the innovative, tech led platforms offered by fintechs. A local retailer, whether it is a kirana store or a pharmacy, can today augment his income by servicing his local community with basic banking and digital products from his store. In the advent of ecommerce and super markets, this allows small and medium businesses to stay relevant and deflect the challenges that come with the evolving economy. From opening a savings account to instant remittances or cash withdrawal points, technology innovations offered by fintech organizations have helped local retailers go beyond their organic business, and double up as the area’s banker, ensuring not only more business but more loyalty from existing customers. This digital empowerment also helps drive the bigger agenda of financial inclusion in the country.

As MSMEs continue to evolve and we see more participation from tech led platforms to augment this evolution, this space is bound to see more innovation in the coming years. The need of the hour is to continue strengthening the sector with the latest advancements and sector friendly policies, so that we are able to create an enriching atmosphere for entrepreneurial growth and an exciting and efficient MSME ecosystem.