For cash withdrawal of more than Rs 1 crore in a year, the government exempted business correspondents last year from additional 2% TDS for cash withdrawal. Unfortunately, most banks do not recognise BC agents who are involved in DBT (direct benefit transfer) disbursements and the TDS gets levied.

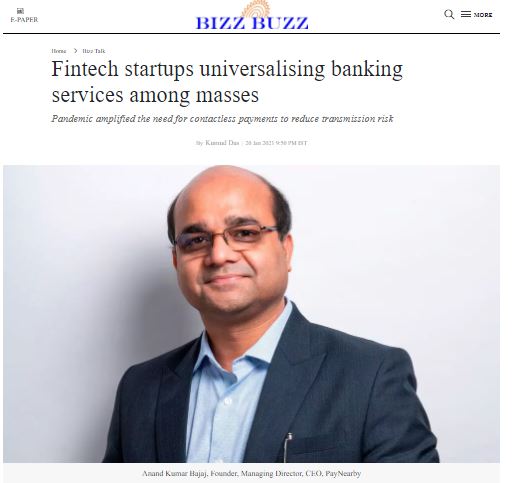

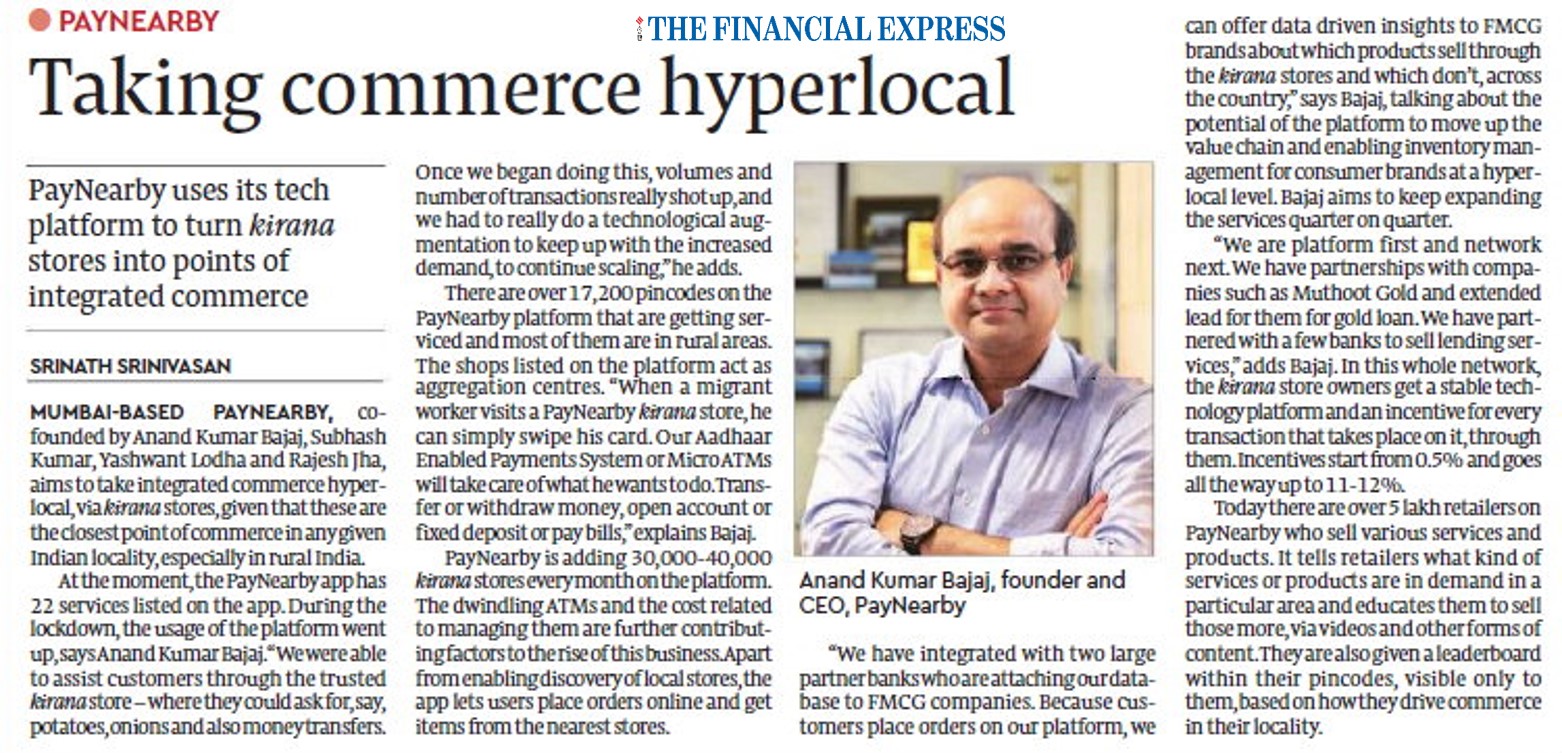

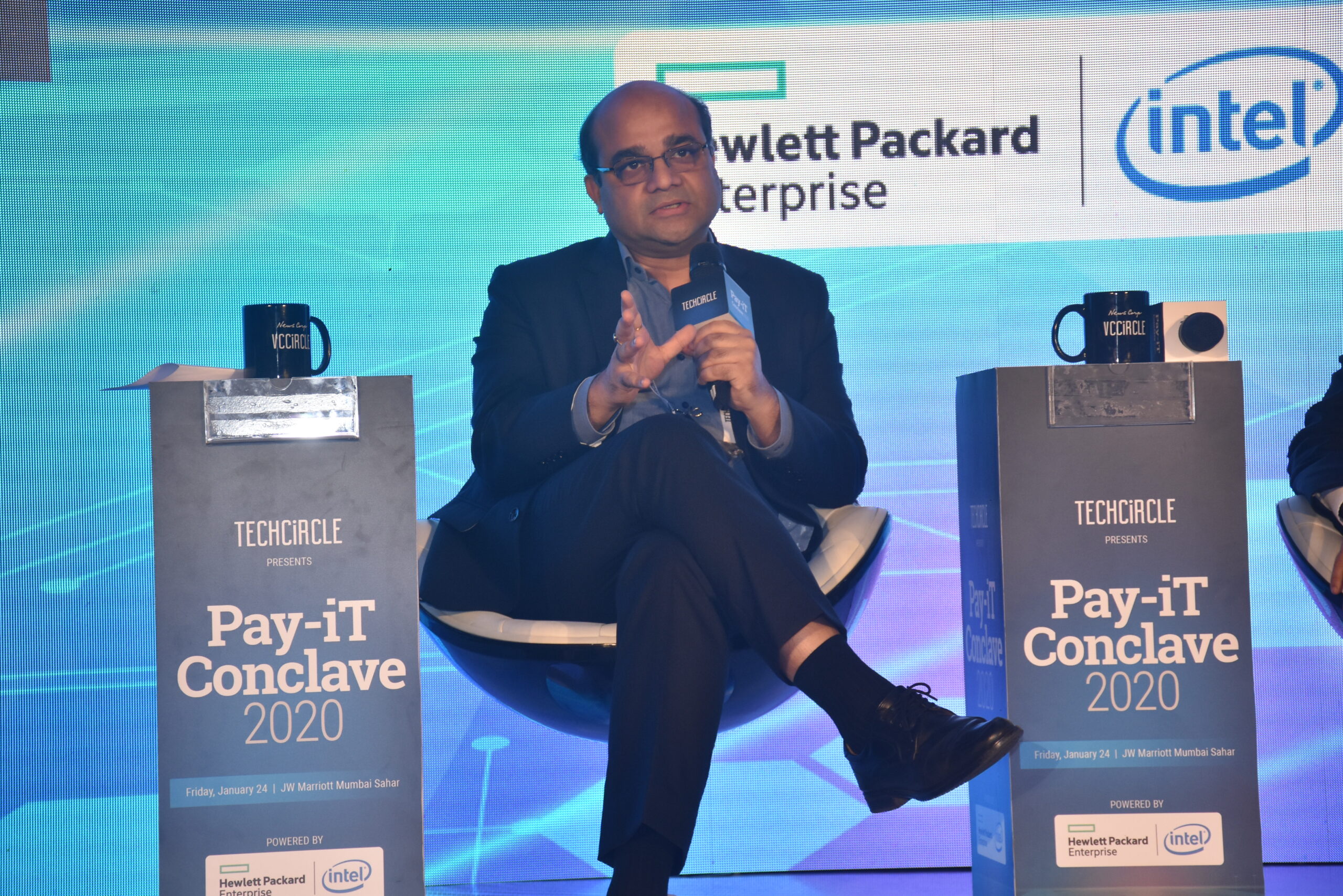

The Business Correspondent Federation of India (BCFI) had flagged a number of challenges faced by the business correspondents in ensuring the relief package announced by the government reach its intended beneficiaries across the country. A month after the lockdown began, the requests of business correspondents remain unheard by the government amidst other priorities, says Anand Kumar Bajaj, vice-chairman, BCFI, and MD & CEO, PayNearby, in a conversation with Hariprasad Radhakrishnan.

Since the Rs 1.7-lakh crore relief package announced by the finance ministry, the BCFI had flagged a number of challenges flagged by the industry body in ensuring the transfer. A month after the lockdown started, have these been addressed?

One request was to include business correspondents’ work under essential services, and this was approved and I am glad that the government called us on national duty. It is not the time to ask for a pound of flesh, but it would be great if the government blessed us and put an arm around us. There are four other key requests we had made to the government through the BCFI. First, there is a GST impact of 27% on BC services. It is unwarranted and may be unintentional. This has been communicated to the government, but there is no action on this.

Second, there is a 10% TDS deducted from BC agents, many of whom run low-income kirana stores. The TDS (tax deducted at source) that is levied blocks capital, and the BC agents may not know how to get a refund. Third, for cash withdrawal of more than Rs 1 crore in a year, the government exempted business correspondents last year from additional 2% TDS for cash withdrawal. Unfortunately, most banks do not recognise BC agents who are involved in DBT (direct benefit transfer) disbursements and the TDS gets levied.

Fourth, just like the insurance cover given to medical forces, the government can provide all 10 lakh BC agents with insurance cover of Rs 50 lakh in the event of death in the line of duty. Because of a sudden spurt in volume of small-ticket Rs 500 transactions, the server traffic has shot up exponentially.

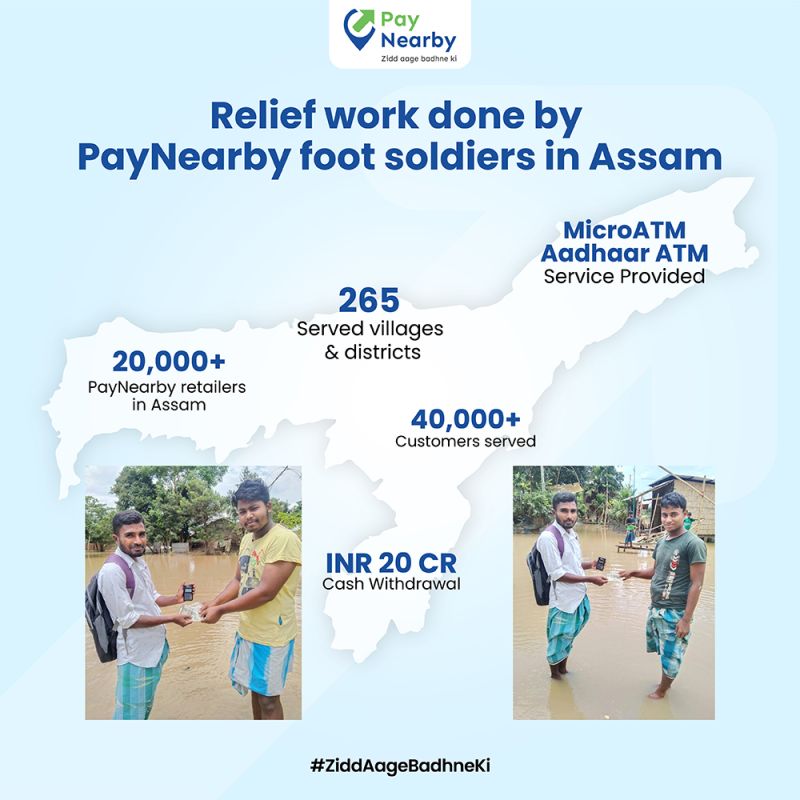

If we had a capacity of 10 lakh transactions earlier, we increased it to 20 lakh transactions a day, but we are now serving 30-40 lakh transactions. With the ticket size being very low, costs have shot up and income has gone down. We requested the government to give half a per cent of the 1.75-lakh-crore relief package as stimulus to BCs who are ensuring the distribution. These requests are unheard right now, as the government has other priorities. But it is important to understand the difficult conditions in which these services are given out. The relief could be distributed through NPCI to active agents serving at least 20 transactions each day amidst the load on the system.

Have the people in rural areas been able to access their relief package, and has the issue of cash shortage in rural areas been addressed?

Cash is also being rationed along with dal, rice and sugar. Not everyone is aware that they have a bank account, and not everyone is aware that they have got the credit of funds. All the money has not been withdrawn, and there are challenges of its own kind in rural areas. There are not enough ATMs and cash supply at the local bank branches where business correspondents are standing in queues for long hours to arrange cash. Further, due to load on banking infrastructure, there is a high failure rate and moreover, the failed transactions are pending reversal in customer accounts for more than 15 days. This is causing disbelief in the system and people are getting angry with the BC agents. It would help to process failed transaction reversals on priority.

Are there challenges in movement of BC agents during the lockdown?

There are some challenges that business correspondents are facing in a very few areas. In most of the places, BCs are supported by the local administrations.

The RBI had mentioned that 80% of BCs are active. Is the current strength sufficient to meet the demand?

There is a need to multiply the business correspondent network by at least two times of what we have today. There are about 8 lakh BC agents serving PMJDY (Pradhan Mantri Jan Dhan Yojana) and normal account holders. The relaxations made by the Reserve Bank of India has helped in reaching the last mile through technology enablement of BC agents. The ATMs are available and the business correspondent network is working alongside in the distribution.

- Source – Financial Express

- Published Date – April 28, 2020