This startup empowers the local kiranas, shops, retail stores & other merchants to offer digital financial and non-financial services to masses.

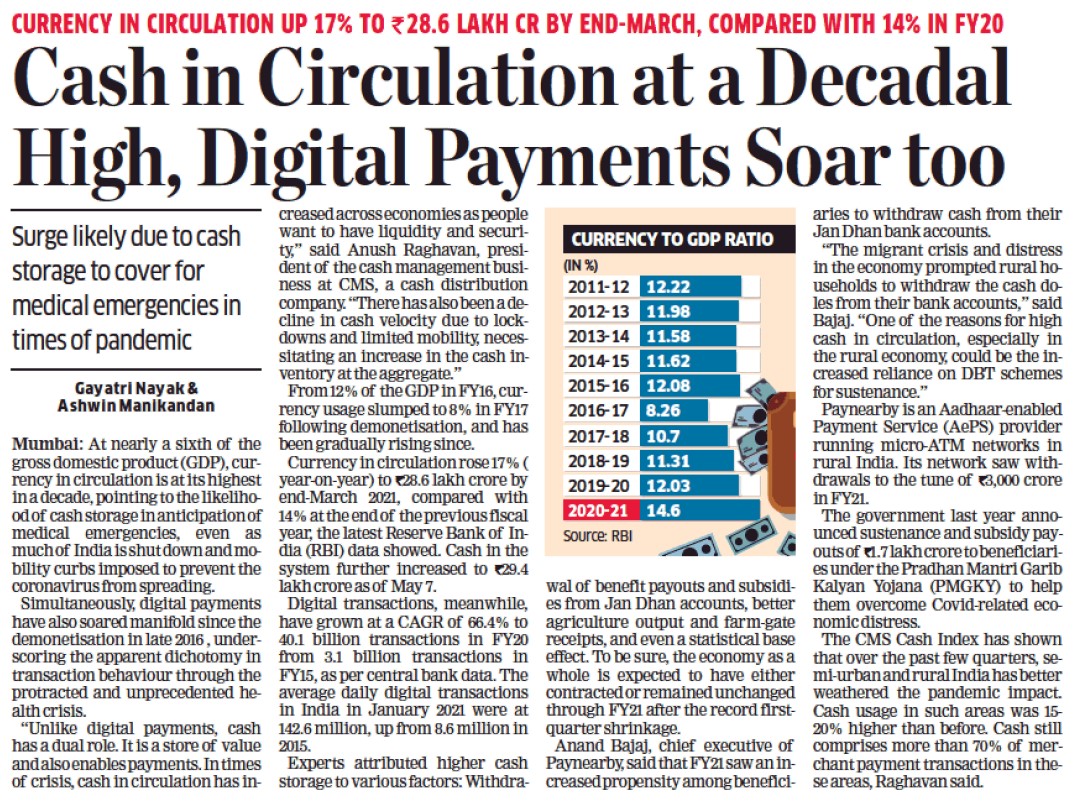

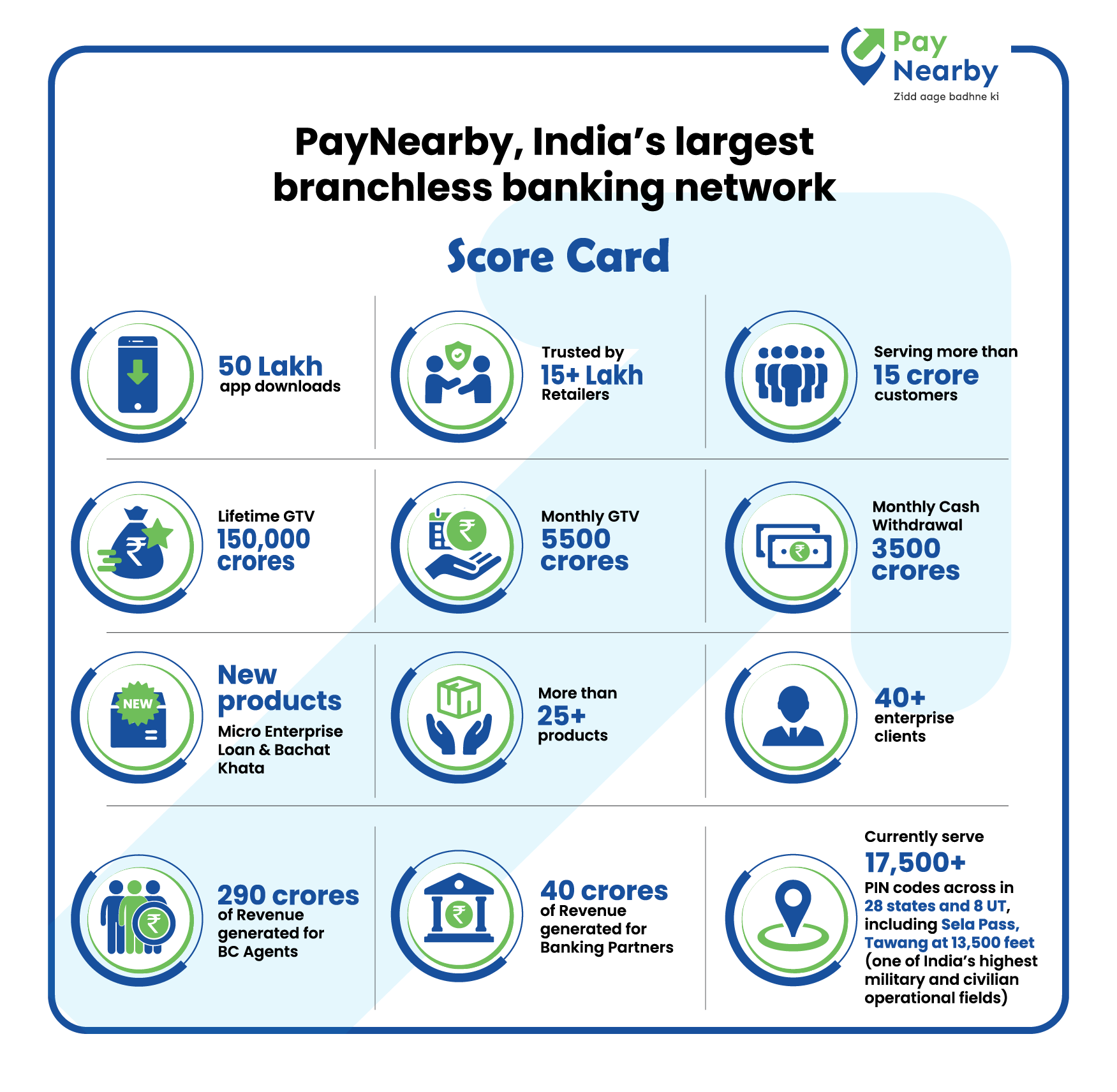

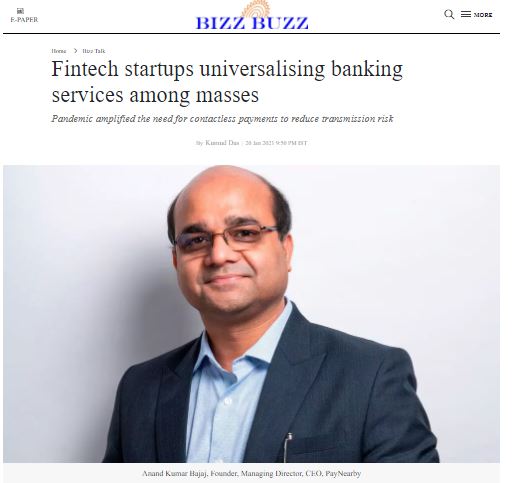

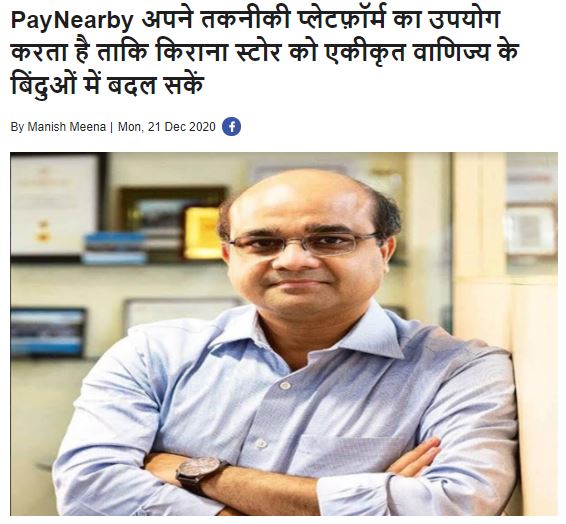

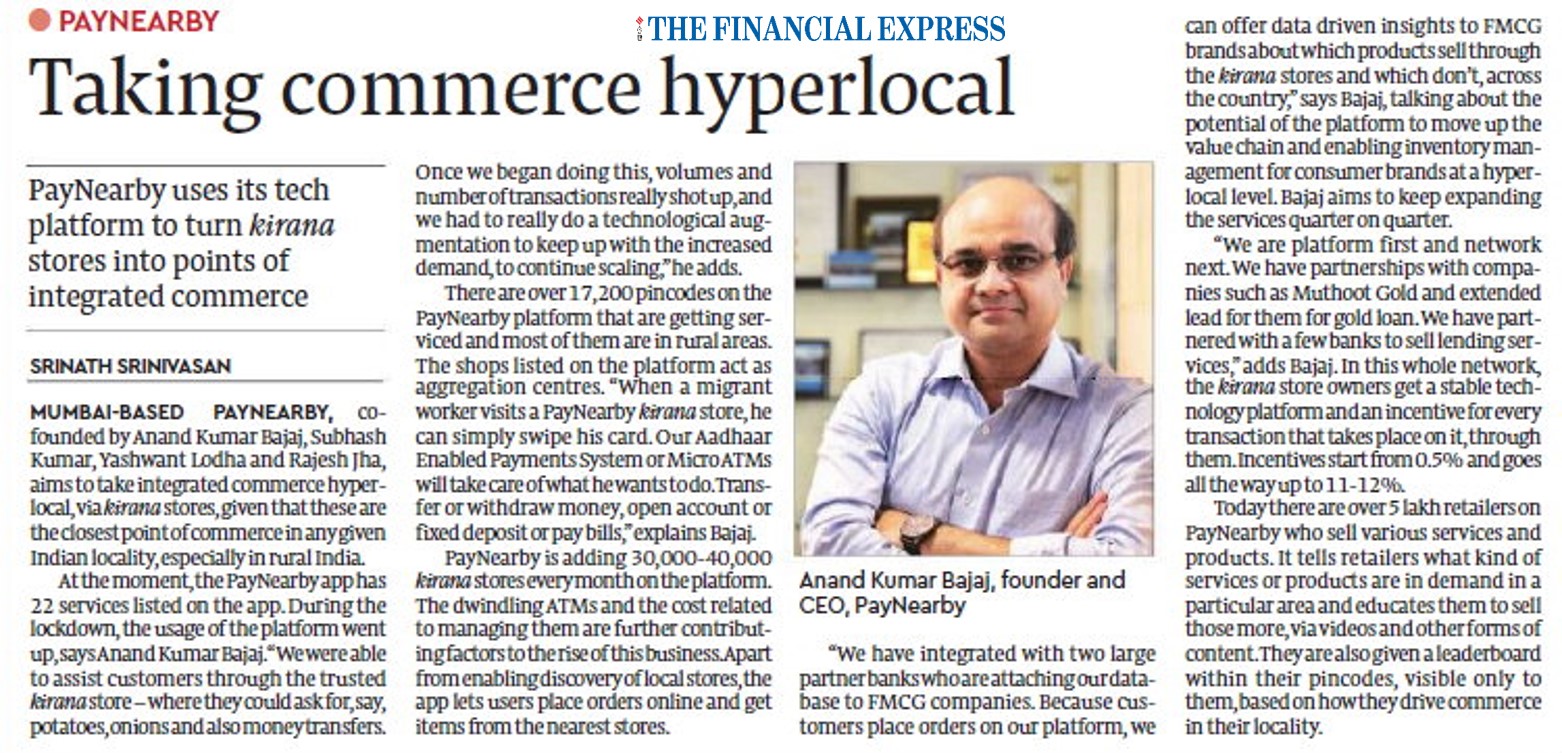

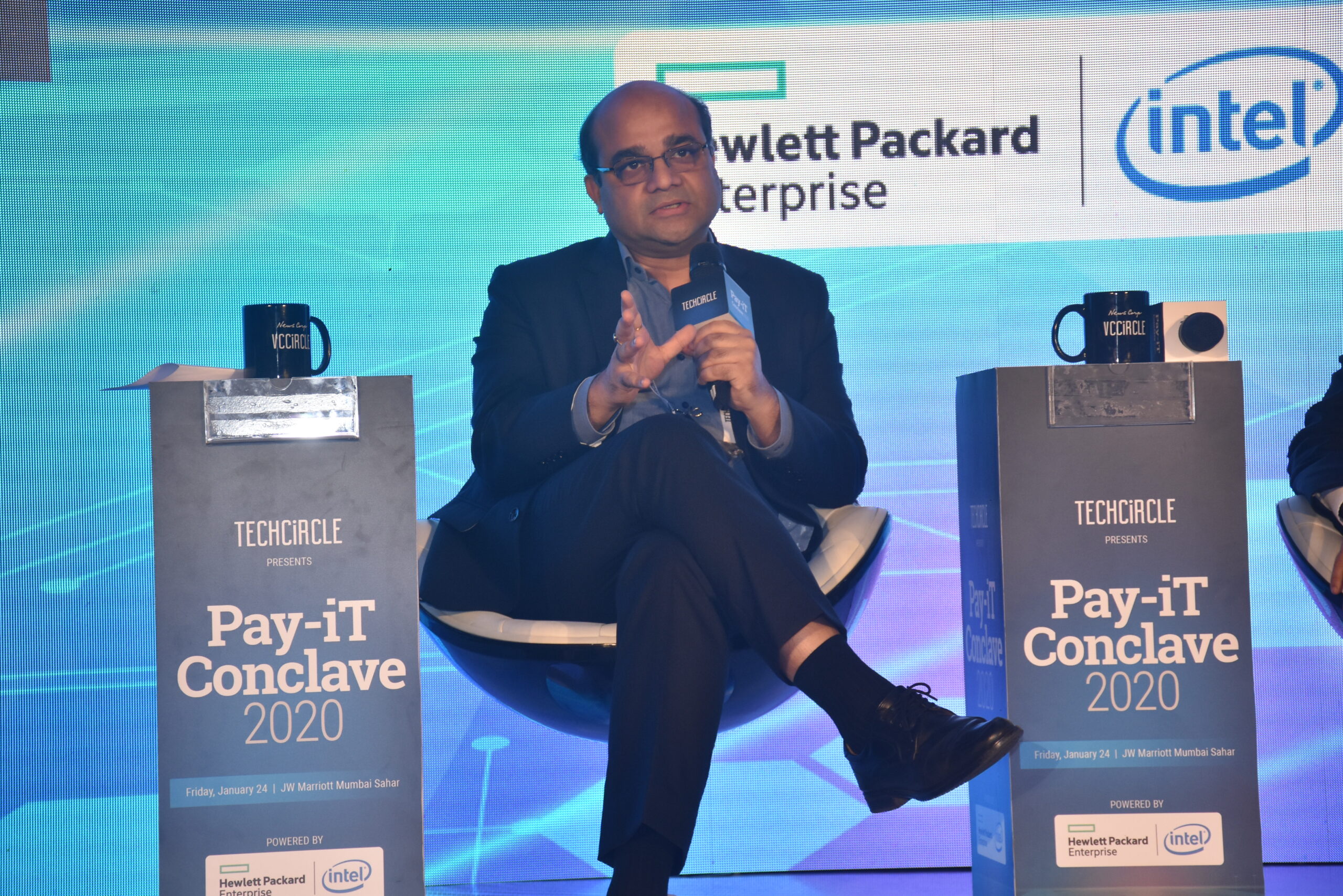

PayNearby is a fast-growing hyperlocal fintech startup that enables retailers at the first mile to offer digital financial and non-financial services to masses. Set up under the department of industrial policy & promotion’s Startup India (fintech category) programme, PayNearby has seen rapid growth in the three years since inception. “Today, more than 6,00,000 retailers use the PayNearby platform to service close to 5 crore Indians on a range of products and services. The success of the model lies not only in the 10 lakh-plus transactions that it clocks daily or the monthly GTV of Rs 4,000 crore-plus, but in the social reach of the platform across 16,700 pincodes in the country, helping uplift both the retail community and consumers in those areas, thereby helping access to the government’s DBT disbursements in an easy manner,” says Anand Kumar Bajaj, founder and CEO, PayNearby.

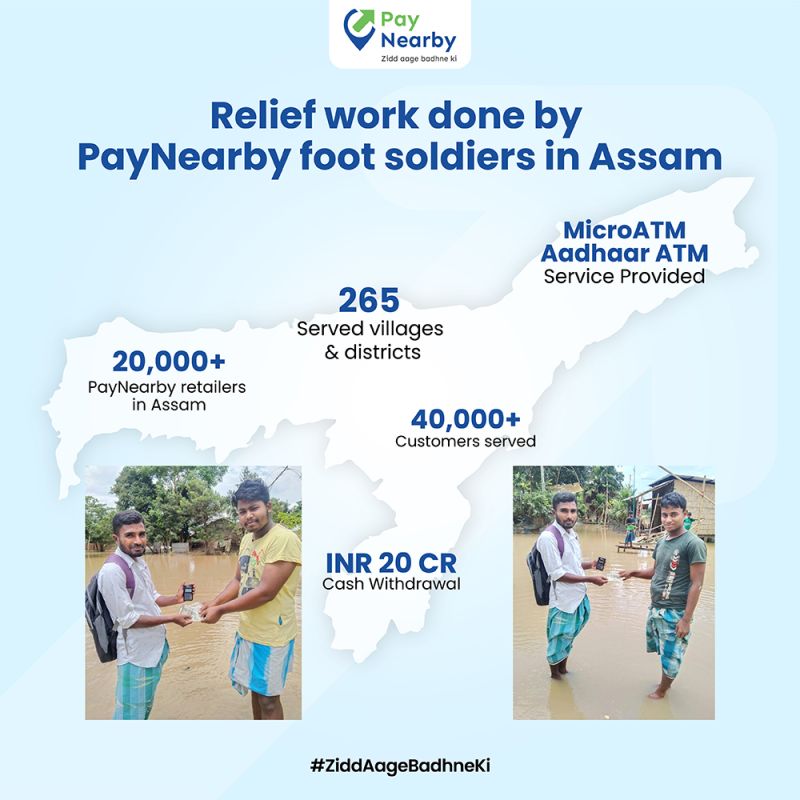

“One of our biggest differentiators in the market is our technology architecture that not only promises highest success ratio, but also ensures that it brings in the maximum efficiency in a retailer’s daily life,” says Bajaj. “The work done by PayNearby has enabled financial inclusion worth `775 crore through 35 lakh transactions in the month of June alone, to the citizens of the 115 aspirational districts, identified by Niti Aayog as the poorest districts of the country,” says Bajaj, who has held various positions at EY, ICICI Bank and Yes Bank, before embarking on his entrepreneurial journey.

“With 97% India remaining to be insured, 92% having not invested in mutual funds, 78% not having access to finance, the banking infrastructure is required to be leveraged and trust needs to be sachetised and provided to the common man at a place nearby. With this hypothesis, PayNearby was set up to provide the last mile access of basic financial services to India’s large underserviced population,” he informs.

The company’s mission to make ‘HarDukaan Digital Pradhan’ is envisaged to empower the local retailer and create a thriving ecosystem for the local community. PayNearby has successfully enabled Digital Pradhans to provide many essential services to their local communities, including Aadhaar banking, bank savings, insurance, access to government schemes and many more. Bajaj says, “This has not only helped the masses to avail financial services, but also helped our retailers stay relevant in today’s evolving economy of e-commerce and large format superstores.”

PayNearby aims to accomplish delivery of an annualised Rs 70,000 crore-plus worth of financial services in FY 2019-20. The company’s financial foundations are based on strong unit economics and creating a business that delivers value and positive economies to all its stakeholders. The startup is funded by Roha Group, the Tibrewala family owned billion-dollar conglomerate with interests in various sector.

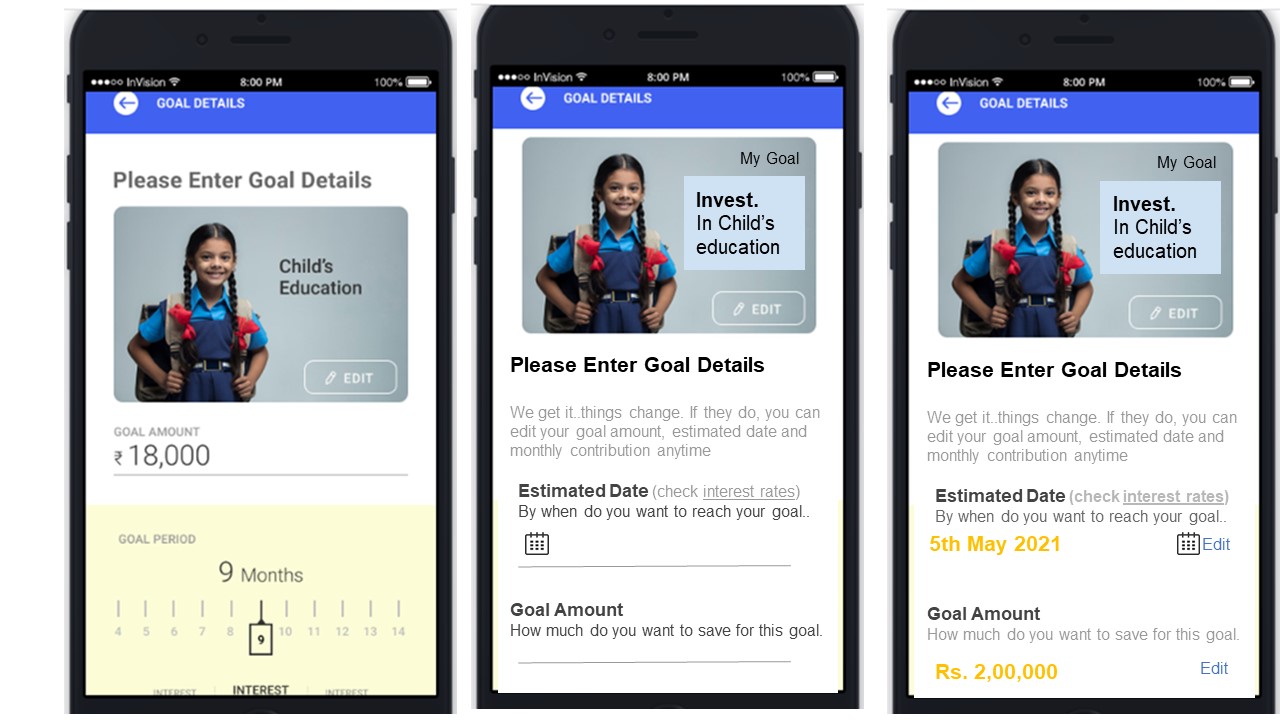

The startup is well-positioned to move to version 2.0 with the launch of multiple new verticals and brands, including TravelNearby and InsureNearby. The foundation is laid for it to make all basic financial and non-financial services available to customers through its local retailer partners – the Digital Pradhan. It has applied for an NBFC licence and wants to meet the financial needs of the retailing community.

From 6,00,000 retailers as of now to 50,00,000 retailers in the very near future, PayNearby has set itself aggressive goals to ramp up and be the port of call for assisted hyperlocal services in the county. The startup also wants to foray into international markets and is evaluating Sri Lanka, Bangladesh, and South Asia markets for future expansion.

- Source – Financial Express

- Published Date – November 10, 2020