A branch of your bank may not have reached some of the most interior rural areas of the country, but you can be sure to find brands of cola and chips at local mom-and-pop stores there. Be it daily groceries, toiletries or even mobile recharge, these stores are an integral part of every neighbourhood.

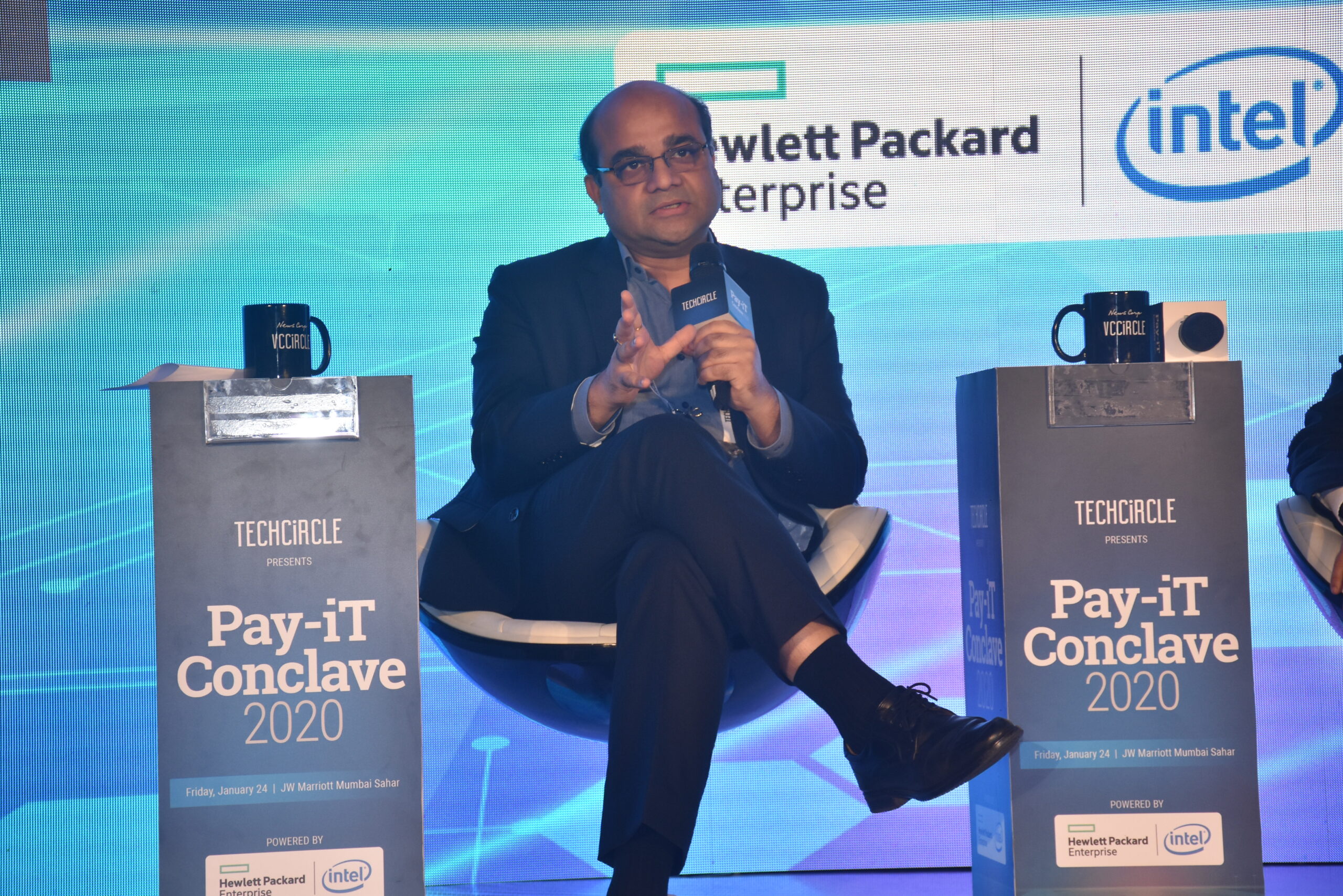

“Two kg onions, 2 kg potatoes and remit Rs 1,000 to my family in my village – a customer can do this as simply as doing a mobile recharge. The opportunity is vast,” says Anand Kumar Bajaj, Founder, MD and CEO of PayNearby, which has built an entire ecosystem of services to ensure financial inclusion to the unbanked and underbanked through neighbourhood stores.

PayNearby, as the name suggests, is looking to bring all essential services to the local retailer, thus helping the local community pay for various services ‘nearby’, while also empowering these retailers through additional revenue streams.

“Unbanked is a mindset. Not just rural areas, even in Mumbai we do a throughput of Rs 400 crore. It is not just about underbanked; unbanked, underbanked and mis-banked is also there. There is a lens that we see our lives with and just outside that spectrum is another set of people we don’t see. So, when you come out with a high-end FinTech product that you can take to the bottom of the pyramid, you can actually granularise, sachet-ise and universalise services for more people,” Anand says.

He adds, “Ask a gentleman who has migrated to a metro about how he sends money to his family? He will tell us all the problems that he faces and it’s those problems that we’re looking to solve.”

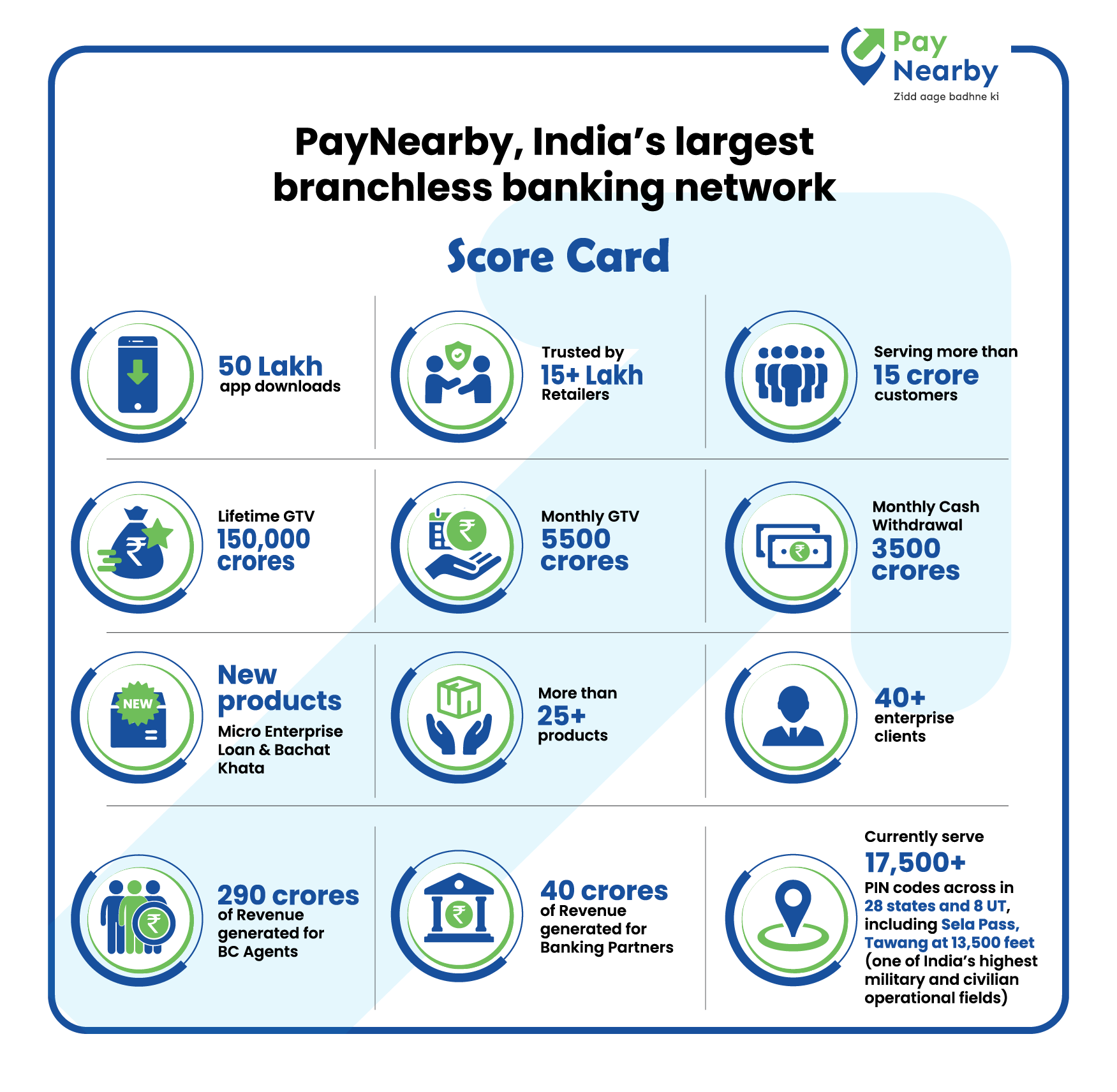

PayNearby has built inroads across the country with 9.5 lakh ‘Digital Pradhans’. These are its retail partners that include grocery, medical, apparel and hardware shops. Through these retailers, PayNearby offers sachets of banking and payment services to the common man.

What are the services offered?

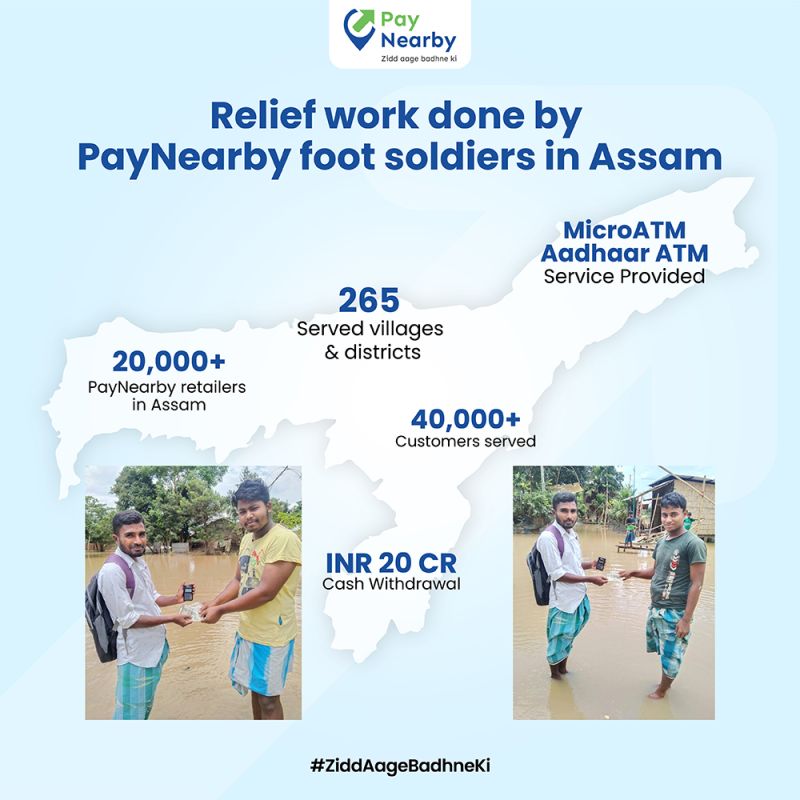

Aadhaar ATM allows retailers to provide basic banking functions such as cash withdrawal, balance enquiry and domestic money remittances to their customers. All a person has to do is walk up to a PayNearby retail store and verify Aadhaar through fingerprint authentication to withdraw cash or instantly transfer money to any bank account in India.

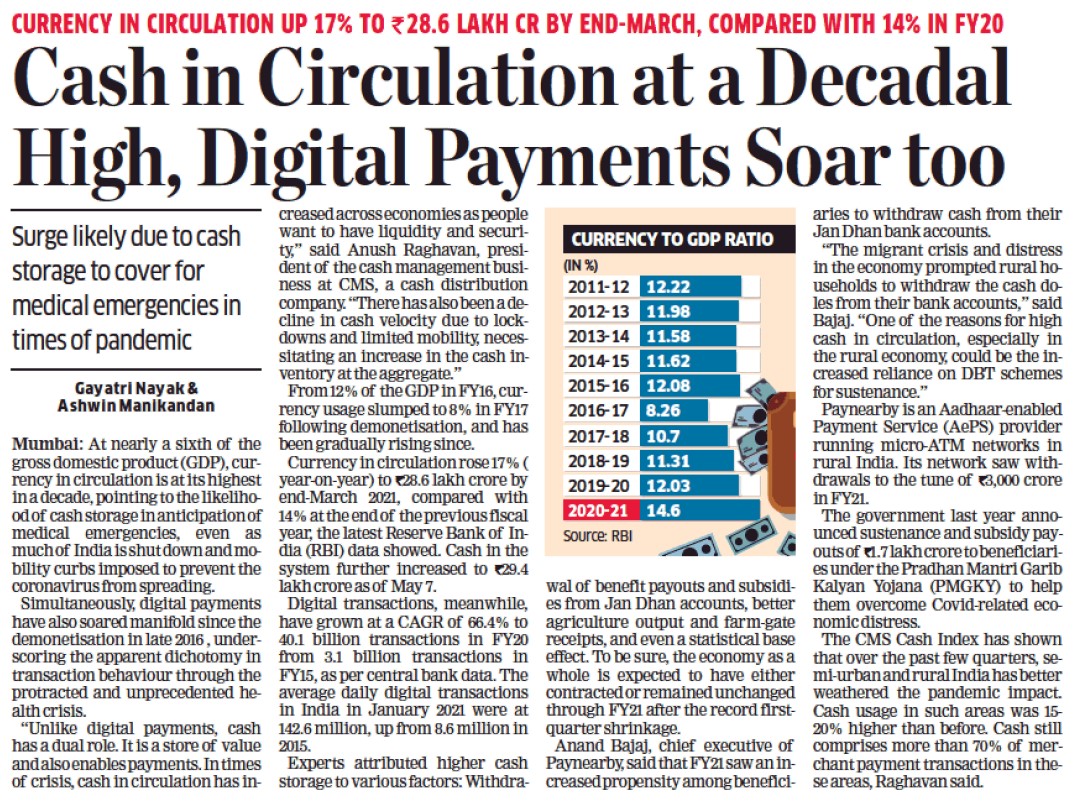

“We do Rs 3000 crore every month of Aadhaar-enabled payment service of the Rs 9000 crore India does. About 93% of transactions are in rural India, where there is scarcity of banks, ATMs and financial services, and that’s the gap we are looking to fill,” Anand says.

For domestic remittances, PayNearby says it mainly targets migrant workers who want to send money back home.

“A migrant who has come to an urban center would earlier have to go to a bank branch, stand in a queue and then deposit money into his bank account so that his family can withdraw. Now, we have taken the banking out of the bank branch and given it to a local neighbourhood store and made the process extremely simple,” Anand adds.

PayNearby claims to process micro remittances of about Rs 1,800 crore a month.

PayNearby also allows retailers to accept bill payments by enabling them with the Bharat Bill Payment System (BBPS). Anand claims that they do about Rs 80-90 crore worth transactions a month, with the average bill size being between Rs 200-250.

For those who have a debit or credit card, it also offers card payment facilities through QR codes and a ‘card not present link’, where the retailer does not need a card swipe machine and the customer need not be in the vicinity.

“So, you are ordering groceries from home and the retailer says its Rs 720 and sends you the link. You say okay, click the link and pay,” Anand adds.

PayNearby also allows retailers to collect EMIs of customers for their bike loan, home loan, etc. In addition, it also offers sachet-sized insurance through retailers.

Anand says that during demonetisation he realised that people, especially women in rural areas, save a lot of money in small amounts around the house. This presented a huge opportunity to offer granular deposits.

“Now imagine these 10 crore customers we are serving today start giving us Rs 100 a month. That is Rs 1000 crore of money coming into the company as micro savings. So, the concept of what we do is called a growing piggy bank. Which means, can you come out and give me your hundred rupees so that I can do a big job with it for you. We are working with the Small industrial Development Bank of India (SIDBI) on this,” he adds.

Speaking of SIDBI, Anand says that while offering these services, PayNearby is able to understand the retailer in terms of how credible he is, how well he responds to customers and therefore what kind of transactions he is able to drive. Through this understanding, PayNearby is now working with SIDBI to offer small loans to these retailers for rates of as low as 8-9%.

PayNearby is looking at an entire spectrum of services, which also includes prepaid cards, travel ticketing, and others. Working with around 9.5 lakh retailers now, the startup aims to grow this to 50 lakh retailers soon.

“We have 10 crore customers, we do over Rs 4,500 crore of throughput every month, which makes us the largest agent banking platform in the entire Southeast Asia region,” Anand claims.

How does this benefit local retailers?

Every retailer onboarded by PayNearby is trained for the services he will be offering. Through the app, the startup also pushes out regular content in local languages to help retailers understand and offer better services.

For every transaction that a retailer does through the app, he earns a commission. It also increases footfall for the retailers.

Data protection?

Given the humungous amount of consumer data being collected by PayNearby, Anand says that the company takes every precaution to ensure the data is not misused. However, with user consent, he is looking at the opportunity to cross-sell more financial products, which, according to him, ultimately benefit the consumers.

“There is a consistency score we have with say a customer who has been sending money every month to his family. Now I ask him if I can use his data to offer him insurance, or a loan. But it has to be with explicit consent in his language, of course,” Anand adds.

The opportunity

Anand calls his startup the OTT of banking. “We are an enabler as a layer. The banks are at the bottom. Then we have their server architecture, the connectivity. Over this we have a layer of trusted retailers. On one side we have supply coming from insurance companies, OTTs, travel, e-commerce companies, all of it. And on the other hand is the unmet demand of India which is where you can reach out the products to,” Anand says.

To further build this framework, he says he can approach all kinds of companies and if they have a product that they want to take to the hinterlands, PayNearby can do that, be it education content, small billing software, surveys, anything.

The focus now for PayNearby is to ensure its spectrum of offerings reach as many customers as possible.

PayNearby, Anand says, is like a Swiss Knife. “Did you know there is a toothpick in a Swiss Knife? Maybe not. But you know it has a bottle opener and a cutter and you have used it too. Now I will offer you the toothpick as well. This way, we want to keep adding new services to PayNearby and then focus on taking the knife to as many consumers as possible,” he adds.

- Source – The News Minute

- Published Date – February 18, 2020