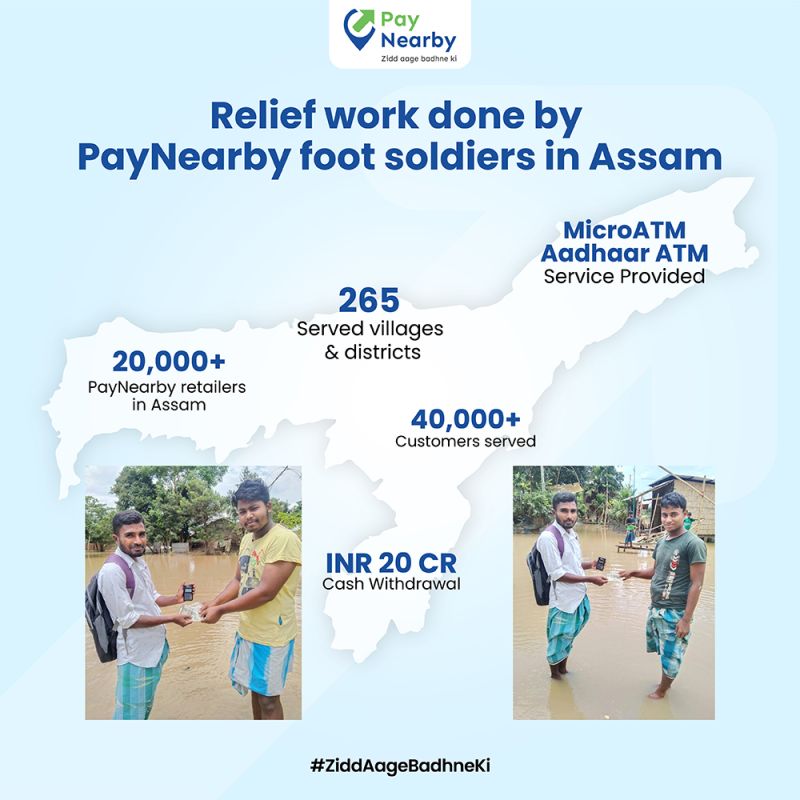

At the posh Alta Monte building in a Mumbai suburb, where apartments sell for close to ₹3 crore each, residents have been queuing up for the past few days to withdraw cash using a fingerprint scanner. Aadhaar-based payments, touted so far as the source of quick access to funds for people dependent on government benefits, has now reached gated communities across the country’s financial capital as people stay away from venturing out to use automated teller machines (ATMs).

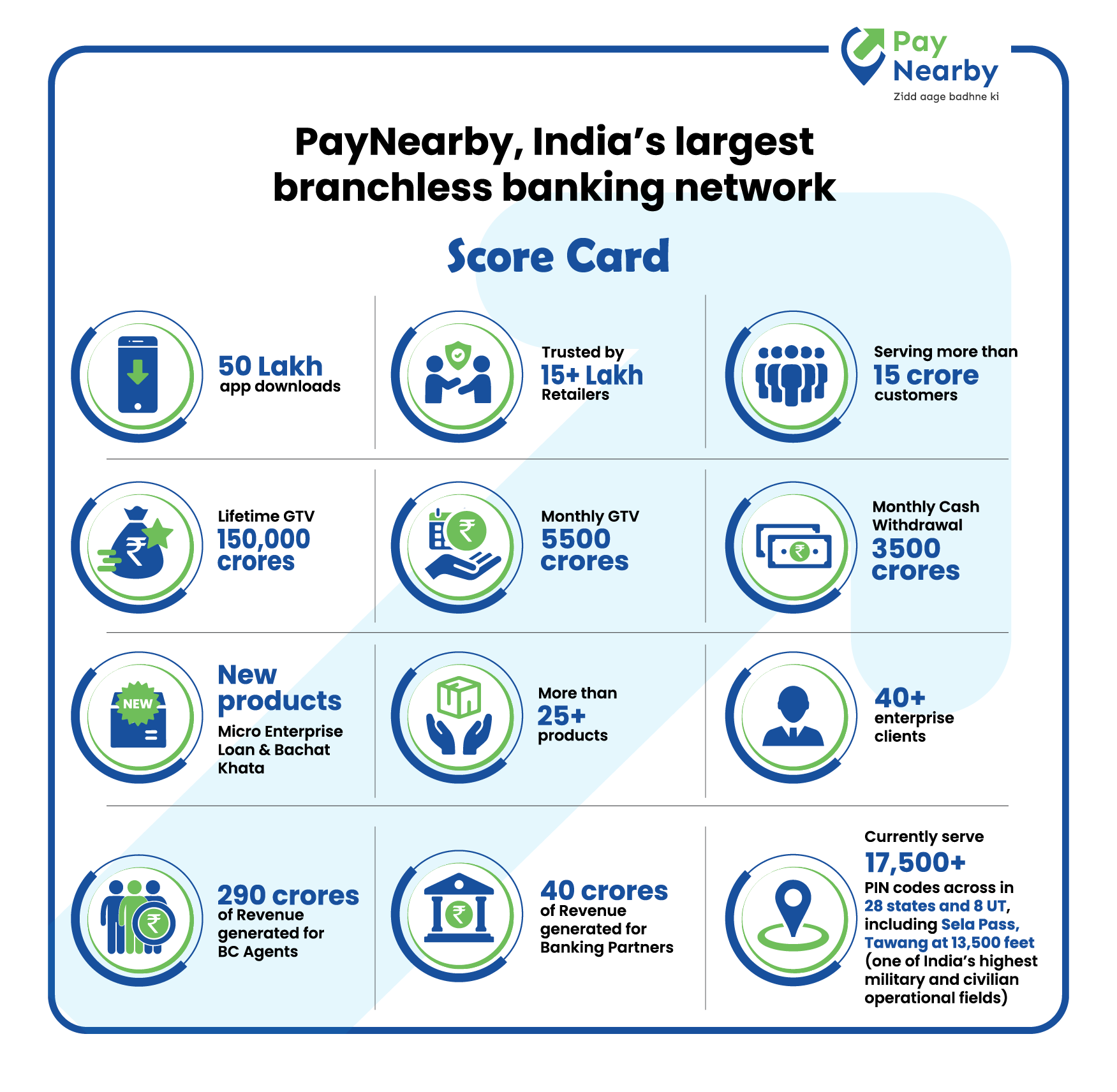

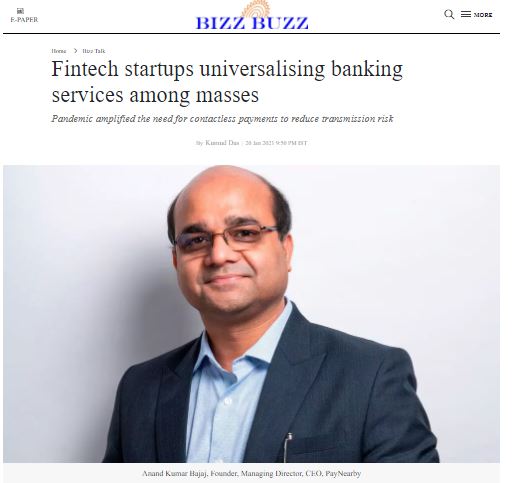

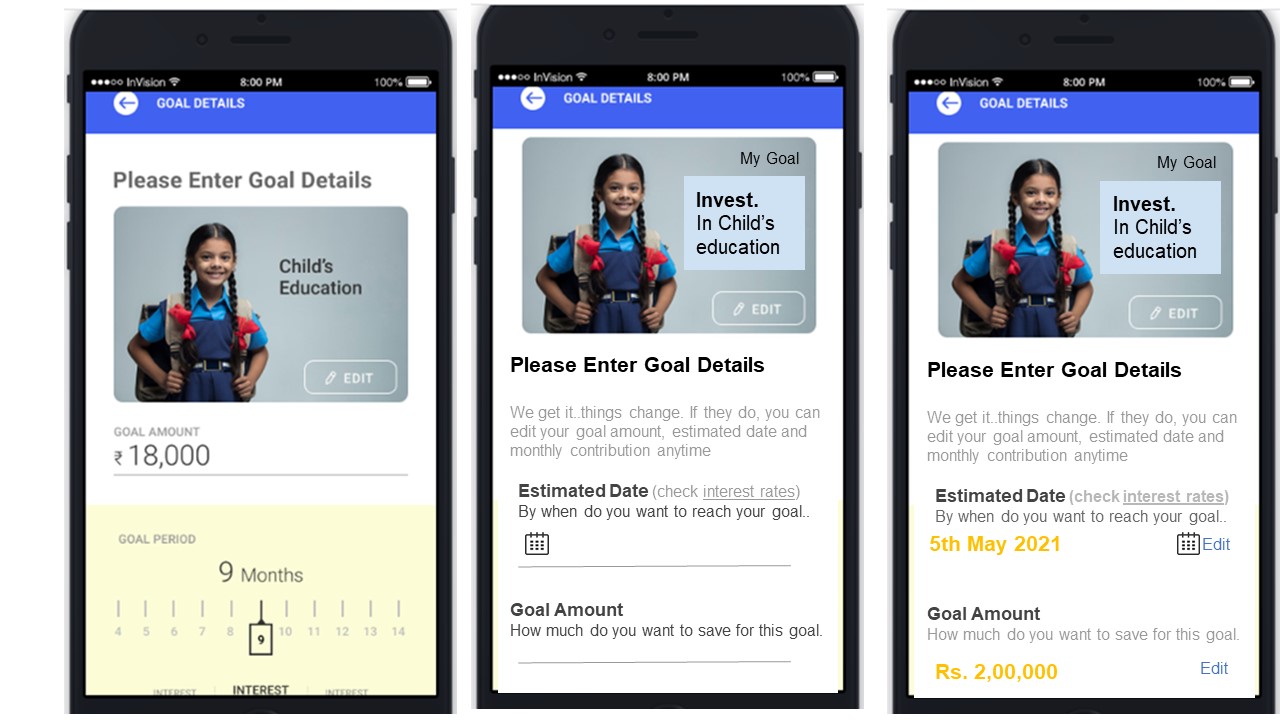

“Aadhaar-enabled payment system (AePS) was thought to be poor man’s fintech, but covid-19 has blurred that distinction,” said Anand Kumar Bajaj, chief executive of PayNearby, a firm that provides digital banking services.

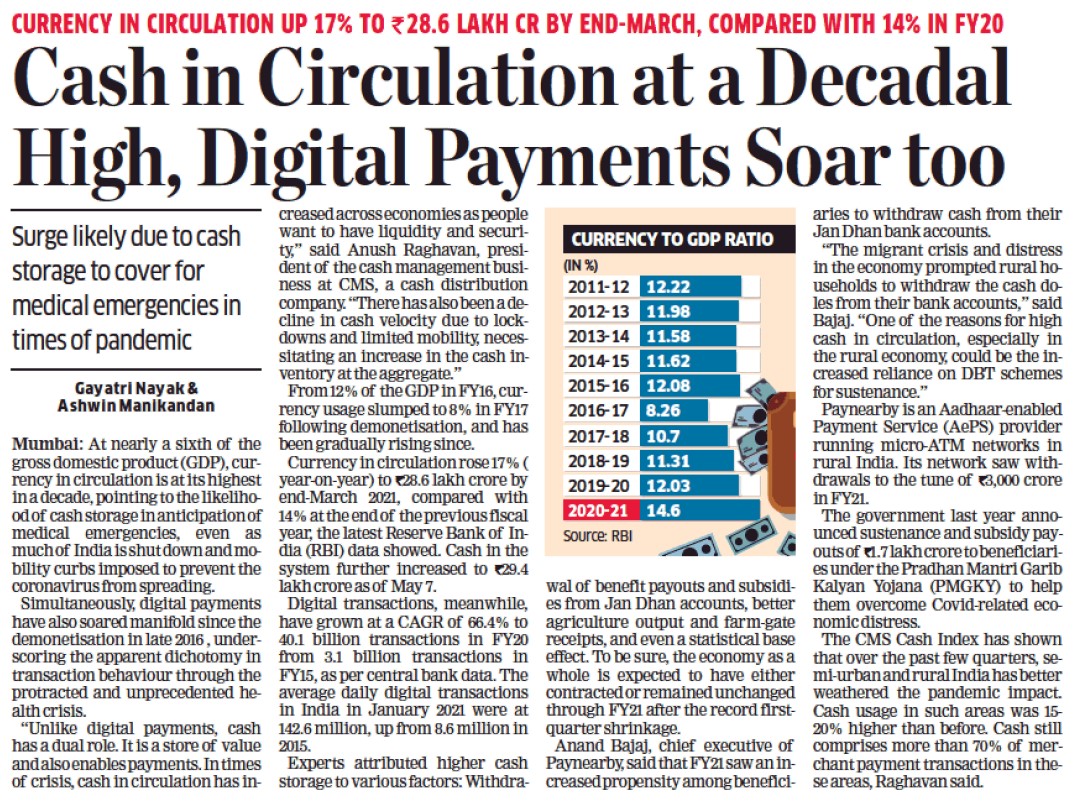

The micro-ATMs outside gated colonies and the fingerprint scanners point to major upheavals that are currently underway within the world of India’s fintech firms. The immediate trigger: since early-March, as fears of a pandemic took root, Indians began to hoard cash. By mid-April, the amount of currency in circulation had hit a 12-year high. Almost in parallel, transaction volumes via unified payments interface (UPI)—the country’s most popular digital payments platform—began to plummet, from 1.3 billion in December 2019 to 1.25 billion in March.

- Source – Mint

- Published Date – April 28, 2020